Is it crazy to launch an ETF business nowadays?

What do Coinshares, Wisdomtree, Invesco, UBS, SSGA all have in common?

They all recently cut fees in order to remain competitive.

Not so long ago, pundits were claiming the ETF price war was over. Well, we guess not.

Obviously this is music to the ears of investors, but must feel like a kick in the nuts for the managers. Which brings us to our question:

Is it possible for anyone to to make money in this industry when,

A. fees are so low and,

B. there is an exception/perception from investors that ETFs are/need to be cheap.

It’s a daunting challenge for the industry to face.

Fund Launches and Updates

EUROPE

HANetf is proposing to merge three thematic ETFs into two of its existing products, as the firm continues to restructure its fund range on low demand.

The $7.1m Solar Energy UCITS ETF (TANN) and the $3.4m S&P Global Clean Energy Select HANzero UCITS ETF (ZERO) will merge into the iClima Global Decarbonisation Enablers UCITS ETF (CLMA).

In addition, the $11.5m Procure Space UCITS ETF (YODA) will merge into the recently launched Future of Defence UCITS ETF (NATO), which houses $45m assets under management (AUM). link

JP Morgan Asset Management (JPMAM) has expanded its range of active ETFs with the launch of core, growth and value large-cap US equity strategies.

The JPM Active US Equity UCITS ETF (JUSE) – which is benchmarked against the S&P 500 – has a total expense ratio of 0.39%, while the JPM Active US Value UCITS ETF (JAVA) and the JPM Active US Growth UCITS ETF (JGRO) both have TERs of 0.49%. link

The UK government has granted equivalence for UCITS ETFs under the Overseas Fund Regime.

This means, once implemented in April, all UCITS vehicles in the European Economic Area (EEA) will be able to passport to the UK. link

BlackRock has added BNY Mellon as a post-trade service provider for its Irish-domiciled ETFs.

BNY Mellon will join State Street as a service provider, covering depositary, fund administration and fund accounting services to a “selection” of its ETFs. The move will lead to a “broadly 50-50 asset split” between depository and administration between State Street and BNY Mellon. link

AMERICAS

Amplify ETFs has completed its previously announced acquisition of ETF Managers Group (ETFMG) (ETF) assets, which consist of over $3.7 billion of assets under management (AUM) across 14 ETFs (as of 1/26/2024). Amplify ETFs will now manage $9.1 billion of AUM as of 1/26/2024. link

Vanguard has launched the Vanguard Intermediate-Term Tax-Exempt Bond ETF (VTEI) and Vanguard California Tax-Exempt Bond ETF (VTEC). The funds allow fixed income investors to reap the benefits of muni funds, each having their own strategic focus. Both funds launched on the Cboe BZX Exchange. link

YieldMax has launched the YieldMax Magnificent 7 Fund of Option Income ETFs (NYSE Arca: YMAG), a fund that invests in seven other YieldMax ETFs, each of which provides options-based exposure to one of the Magnificent Seven stocks. YMAG has an expense ratio of 1.28%. link

NEOS ETFs have rolled out the NEOS Nasdaq 100 High Income ETF (QQQI). The fund pairs exposure to a major index with a complementary options strategy intended to provide investors with monthly income. QQQI lists on the Nasdaq stock exchange and has an expense ratio of 0.68% link

Neuberger Berman has converted its Neuberger Berman U.S. Equity Index PutWrite Strategy Fund into the Neuberger Berman Option Strategy ETF (NYSE Arca: NBOS).

The new ETF comes to market with roughly $480 million in assets under management, which makes it the largest fund in the Neuberger Berman ETF lineup. link

ASIA-PACIFIC

Harvest Fund Management, has reportedly applied to local regulators for permission to launch a bitcoin spot exchange-traded fund. This makes Harvest Global the first fund house in Hong Kong to apply for a bitcoin spot ETF. link

CSOP Asset Management is aiming to profit from Japan’s hot stock market by introducing the first Nikkei 225 Index ETF in Hong Kong to track the index.

The CSOP Nikkei 225 Index ETF, which has amassed an initial investment of US$13 million, made its market debut on the Hong Kong Stock Exchange on Wednesday, listing at HK$78 (US$9.97) per unit and carrying a 0.99% management fee. link

Taiwan’s Financial Supervisory Commission is planning to allow active ETFs and propose crypto regulation this year. New active ETF rules set to be rolled out in a booming market where Taiwan investors boosted ETF assets by more than 60% last year. link

Our newest podcast where we explore the stories behind companies who have achieved success in the ETF ecosystem, trying to uncover what led to that success.

Click HERE to listen to listen those stories.

Flows

Amid a year of economic gloom, China’s A-shares market ended 2023 as the worst performing large stock market in the world, with the CSI 300 Index of Shanghai and Shenzhen-listed stocks falling more than 11%.

While Chinese investors shunned active stock mutual funds, equities ETFs enjoyed record high inflows of Rmb479 billion last year, nearly double the previous year.

Overall China’s ETF market grew by more than 20% last year as assets surpassed Rmb2 trillion. link

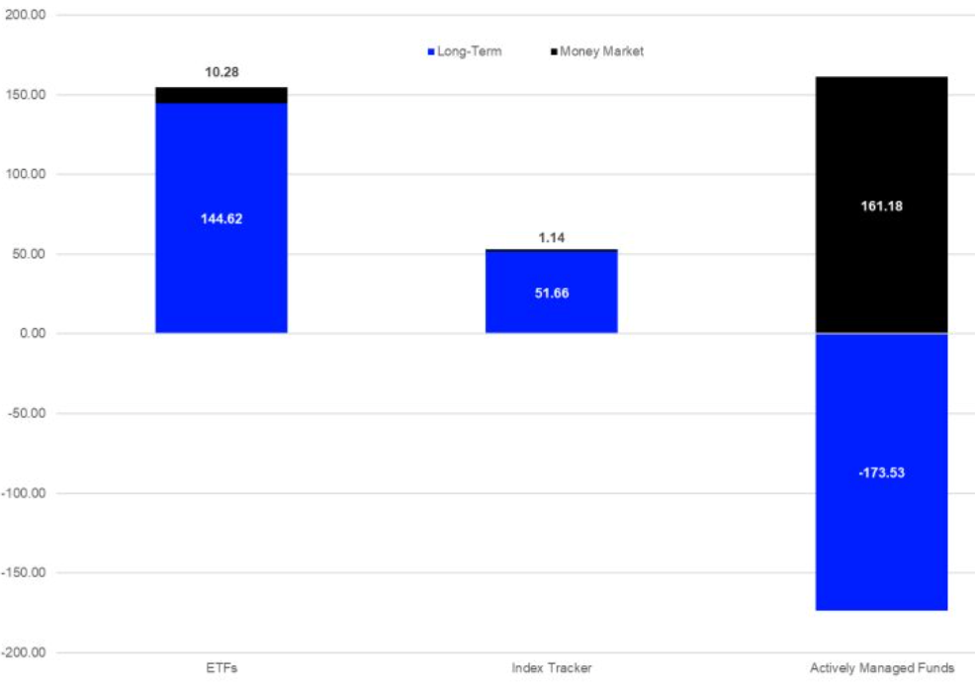

European Mutual Funds beginning to feel the pain as actively managed long-term mutual funds faced outflows (-€173.5 bn) in 2023.

Source: LSEG Lipper

2024 is shaping up as a good year for US ETF inflows.

Investors added a net $29.5 billion to U.S.-listed exchange-traded funds during January, according to etf.com data.

That’s less than the $50 billion of inflows in January 2023 and $37 billion in January 2022, but it’s still a solid showing.

Flows were particularly strong for U.S. fixed income ETFs, which picked up $17.4 billion of new money. U.S. equity ETFs gathered a more modest $8.7 billion, while international equity ETFs netted $5.5 billion. link

Noteworthy

Is France the new Germany for Retail ETF investing?

ETF retail adoption grew by 18% in 2023, rising from 250,000 in 2022 to 296,000 last year, according to figures from the AMF.

It comes following a bumper Q4 for retail investors using ETFs in the country, with the count rising 34% year-on-year to 166,000 for the quarter. link

Active ETFs seems like the shiny new car that everyone wants to have these days, but not so in Australia it seems.

Australian investors withdrew approximately A$1 billion (US$651 million) from actively managed exchange-traded funds last year amid the rising popularity of passive investing in the market, Money Management reports, stating the most popular vehicles being low-cost vanilla ETFs:

“Active ETFs entering the Australian market have not gained the same level of resonance among local investors,” Global X says in the report.

Australia, which was the first market in APAC to permit active ETFs in 2015, saw appetite for these strategies drop to US$558 million during the first eight months of 2023, from US$648 million and US$941 million in the same period of 2022 and 2021 respectively.

This mirrors a regional trend as net flows into active ETFs across three other APAC markets where they are permitted, namely Hong Kong, Indonesia and Taiwan also fell over the same period. link

The UK is becoming increasingly isolated as one of the few major global markets to continue to hold back from approving retail access to cryptocurrency ETPs. link

Movers and Shakers

Simon McGhee has joined the ETP and Fixed Income Sales Trading team at Virtu Financial.

Denise Kock has joined the ETF Sales team at Invesco in Germany.

From behind the Desk

As we are in the middle of bonus season, we ran a pool recently to get a vibe for how people was feeling so far.

Here are the results:

I’m happy with what I received: 24%

I feel neither good or bad about what I receive: 40%

It was so bad I want to leave: 35%

So nearly a quarter were happy and the rest are either on the fence or ready to hit the road.

One month into 2024, we are noticing a definite trend in people looking for new opportunities…WAY up on previous years.

- People are irritated that their firms are playing big brother and rowing back on flexible working.

- More people are getting worried about what AI is going to do to their job.

- Demand for coding experience is rocketing.

About us

Blackwater is a leading global ETF Consulting, Recruiting, PR and Content Creation firm.

We are specialists in helping companies find the best strategy to enter and navigate the ETF marketplace, enhance their reputation, craft innovative and engaging targeted ETF content and source the very best of talent across the ecosystem.

If you would like to discuss any of the above then please reach out at mike@blackwatersearch.com