Do women care less about salaries than men?

We are currently conducting a global ETF salary survey, which has been open for two weeks now. Looking at the engagement last week, there was one trend that immediately stood out to us. Women only represent 12% of our results so far.

WOW, we thought, how can that be?

Do women care less about salaries than men? We doubt it. Maybe they feel less engaged in such things as they assume they’re paid less than men anyway? Again, that feels like a weak argument to us. Either way, 12% is not a good result.

So, to all the women reading this, please take action and fill out this survey.

It’s 100% confidential and your participation is helping all the other women out there.

Fund Launches and Updates

EUROPE

ARK Invest Europe has launched of three actively managed ETFs covering innovation, genomics and artificial intelligence (AI). The three ETFs are listed on Deutsche Borse, London Stock Exchange and CBOE Amsterdam, while Euronext Milan and Six Swiss Exchange listings are due “in the coming weeks”.

Each ETF has a total expense ratio (TER) of 0.75%. The three ETFs are: ARK Innovation UCITS ETF (ARKK), ARK Genomic Revolution UCITS ETF (ARKG), ARK Artificial Intelligence & Robotics UCITS ETF (ARKI).

Legal & General Investment Management (LGIM) has expanded its commodities range with the launch of an energy transition ETF.

The L&G Energy Transition Commodities UCITS ETF (ENTR) is listed on the London Stock Exchange, Deutsche Boerse, Borse Italiana and the Six Swiss Exchange with a total expense ratio (TER) of 0.65%.

The ETF industry in Europe has celebrated its 24th birthday.

On April 11, 2000, the first two ETFS based on the EURO STOXX 50 and the STOXX Europe 50 were listed on Deutsche Börse in Germany.

AMERICAS

The past week was exceptionally quiet for the ETF space, with almost no activity. Simplify Asset Management rolled out the only new ETF to launch during the week.

The Simplify NEXT Intangible Core Index ETF (NXTI) and the Simplify NEXT Intangible Value Index ETF (NXTV) both track indexes that select their holdings based on intangible assets.

Intangible assets, according to a press release from Simplify, can include things like patents, brand value, and research and development activities. Both funds list on the Cboe BZX Exchange and have expense ratios of 0.25%.

ASIA

Hong Kong’s spot crypto ETFs could attract a “healthy” figure of up to US$1 billion if the city’s infrastructure and ecosystem can be improved quickly said Eric Balchunas, senior ETF for Bloomberg. Growth could be impeded by ineligibility of mainland Chinese investors to buy these strategies, as well as slow local infrastructure build-out.

ChinaAMC has become the first ETF manager to receive regulatory approval for spot Bitcoin ETF and spot Ethereum ETF.

Franklin Templeton has rolled out two actively managed ETFs for Australian investors as part of efforts to “democratise access to high-quality investment strategies”. The new “flagship” Franklin Australian Absolute Return Bond Fund and Franklin Global Growth Fund were listed on the Australian Securities Exchange.

Russell Investments has launched its latest ETF in Australia that will tap into global asset managers’ expertise in ESG investing. The Russell Investments Sustainable Global Opportunities Complex ETF is actively managed and will select managers that prioritise the 2015 Paris Agreement on climate change.

A podcast series focused on exploring the career journey of industry leaders within the ETF and Digital Assets space. Click to listen those stories HERE.

Flows

European investor allocations to ESG ETFs slowed down in the first quarter of 2024 as the sector goes through “a period of existential crisis”, according to new Morningstar research.

Net flows into ESG ETFs totaled €7.1bn in the first quarter, down from €13.8bn in the previous three-month period. ESG sales represent 16% of total ETFs inflows during the quarter, compared to 29% in the previous period, the researchers find.

“This means further deceleration from the highs of 2022 when close to 65% of all flows into the European ETF market were directed to ESG- themed strategies”, says Jose Garcia-Zarate, associate director of passive strategies at Morningstar.

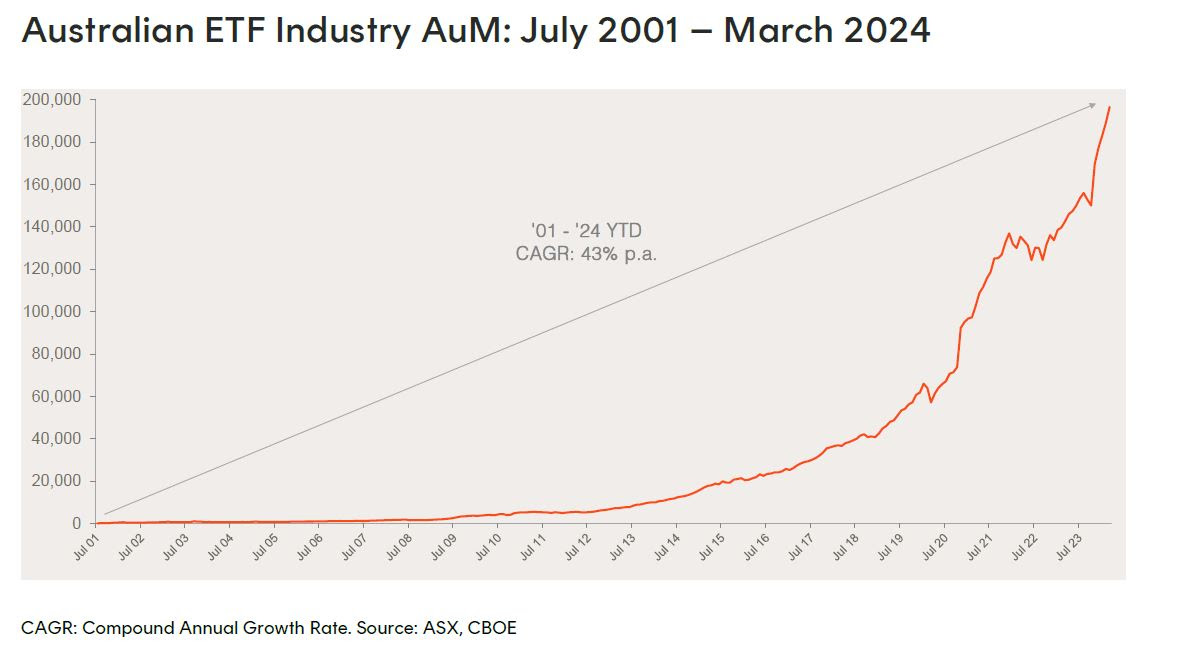

The Australian ETF industry hit a new all-time high in assets under management in March, ending just shy of the $200B milestone, with industry growth driven by a combination of asset value appreciation and investor net inflows.

March saw assets grow 3.9% month-on-month, for a total monthly market cap increase of $7.3B, with the industry reaching a new all-time high of $196.7B.

Net inflows for the month were $1.8B, representing ~25% of the industry’s growth in March. Over the last 12 months the industry has grown by 37.9%, or $54.1B.

Noteworthy

ETFs have taken over as the dominant holding in the fast-growing multi-trillion-dollar US model portfolio market, helping to turbocharge their already rapid growth, according to an article from Steve Johnson at the FT.

ETFs accounted for 51 per cent of underlying assets at the end of last year, up from 46.7 per cent in early 2022, according to data from Broadridge Financial Solutions, a financial technology company, which puts the size of the US model portfolio market at $5.1tn.

Scalable Capital has seen its client assets double to €20bn within 18 months, fueled by the rapid adoption of ETFs among European investors.

The German investment platform’s assets have ballooned over the last three years, reaching €10bn in August 2022 and more than doubling from one year before. The growth has been largely attributed to high demand for ETFs as the firm’s client base has grown to over one million.

Charles Schwab is “closely” watching the UK regulatory landscape in the hope of distributing its US-domiciled ETFs into the market later this year.

Such a move would only be possible if the UK grants equivalence to US funds under its post-Brexit overseas fund regime.

From behind the Desk

3 reasons you should change your job more often:

It’s often frowned upon when people frequently change jobs. It’s almost become taboo in the industry. But is it such a bad thing? I would argue that staying at the same company for too long, or worse, your entire career, creates 2 outcomes:

- You become institutionalised in your way of thinking.

- You become stale.

Neither of these are good for your career.

On the other hand, working at different organisations:

1. Broadens your experience to different cultures and different ways of thinking

2. Requires you to build new relationships each time

3. Expands your personal network

All of these arguably make you a more rounded prospect.

We don’t buy the whole lack of commitment or loyalty accusation that companies throw out regarding this topic. Frankly, that’s horseshit. Be under no illusion that if you no longer fit their plans, they will drop you like a hot potato. Quid pro quo.

About us

Blackwater is a leading global ETF Consulting, Recruiting, PR and Content Creation firm.

We are specialists in helping companies find the best strategy to enter and navigate the ETF marketplace, enhance their reputation, craft innovative and engaging targeted ETF content and source the very best of talent across the ecosystem.

If you would like to discuss any of the above then please reach out at mike@blackwatersearch.com.