Another report out this week, this one from Charles Schwab advocating the take up of ETFs as the investment vehicle of choice from the tech savvy generations.

Whilst this report was US focused, its findings very much mirror what BlackRock published earlier in the summer about the European ETF landscape. Younger people like ETFs, simple.

All of which begs the question: how fast is the market going to shift whereby ETFs become the dominant wrapper of choice and when that happens who is going to get caught out?

The warning signs are certainly there, but unfortunately there will always be folk who don’t head those warnings.

Fund Launches and Updates

EMEA

State Street Global Advisors (SSGA) has the scissors out as it is set to offer the cheapest ETF in Europe after slashing the fees on its S&P 500 product by two-thirds.

Effective 1 November, the $5.5bn SPDR S&P 500 UCITS ETF (SPY5) will see its total expense ratio (TER) cut from 0.09% to 0.03%, the cheapest S&P 500 ETF on the European market, undercutting the Invesco S&P 500 UCITS ETF (SPXS) and its 0.05% TER.

It has also cut the expense ratio on its euro government bond ETF by a third. The $1.2bn SPDR Bloomberg Euro Government Bond UCITS ETF (SYBB) will see its total expense ratio (TER) slashed from 0.15% to 0.10%. citywire

Franklin Templeton is proposing to slash its fees and exclude China from its Asia ex Japan ETF as it looks to switch from a multi-factor strategy to core passive.

In a notice to shareholders the US manager proposes to change the benchmark of the $10m Franklin AC Asia ex Japan UCITS ETF (FRQX) from the LibertyQ AC Asia Ex Japan Equity index to the FTSE Asia ex Japan ex China index.

Following the change, the ETF will be renamed to the Franklin FTSE Asia ex China ex Japan UCITS ETF and will see its TER drop from 0.40% to 0.14%. ignites

Amundi has “almost entirely” realised the operational benefits of integrating Lyxor as passives accounted for most of the firm’s inflows in Q3.

The French asset manager said its costs increased by 2.3% versus Q3 2022 but the impact of some new expenses had been offset by efficiencies afforded by combining Lyxor personnel and products with its own.

The firm has renamed 38 Lyxor ETFs and merged six ETFs since the start of Q3. etfstream

Ark’s Cathie Wood has labelled Europe and the UK ‘most complicated region’ saying the market will be a ‘tough nut to crack’, following deal to buy Rize ETF. There is truth in that but has seen seen the Asian market? That will spin her head. ft

AMERICAS

Goldman Sachs Asset Management (GSAM) has launched a pair of defined outcome ETF.

The new funds – the Goldman Sachs S&P 500 Core Premium Income (GPIX.O) and the Goldman Sachs Nasdaq 100 Core Premium Income ETF (GPIQ.O) – will use an options overlay strategy to limit downside risk and generate income, said Michael Crinieri, global head of ETFs at GSAM. reuters

BlackRock has launched an actively managed ETF that seeks to tap into rising demand for funds run by a manager tasked with beating the broader market.

The BlackRock Large Cap Core ETF (BLCR) follows on the heels of the BlackRock Large Cap Value ETF (BLCV), which the firm rolled out in May, marking the start of a new push into the active-ETF space.

At the roundtable coinciding with BLCV’s launch, BlackRock said that the fund was its first stock ETF designed to be a main holding for investors. The fund shop has launched more than a dozen active ETFs since then, including BLCR. BLCR has an expense ratio of 0.36%. etf.com

DWS rolled out the Xtrackers USD High Yield BB-B ex Financials ETF (BHYB) on Friday.

The fund tracks the ICE BofA BB-B Non-FNCL Non-Distressed US HY Constrained Index of domestically issued bonds drawn from the top tier of the high-yield space. BHYB has an expense ratio of 0.20% and lists on Cboe Global Markets.

Grayscale Investments has unveiled a framework for categorising the digital asset ecosystem and has partnered with FTSE Russell to introduce a suite of sector-focused crypto indices.

The FTSE Grayscale Crypto Sector Index series consists of five rules-based indices that aim to capture the investable crypto market articulated by Grayscale’s framework.

The five Crypto Sector Indices introduced are Currencies, Smart Contract Platforms, Financials, Consumer & Culture, and Utilities & Services. Collectively, they cover over 150 protocols and are reassessed quarterly to remain aligned with the dynamic nature of the crypto asset class. etfstrategy

First Trust further expanded its lineup of buffer ETFs with the launch of the FT Cboe Vest U.S. Equity Moderate Buffer ETF – October (GOCT), the FT Cboe Vest U.S. Equity Enhance & Moderate Buffer ETF – October (XOCT) and the FT Cboe Vest Laddered Moderate Buffer ETF (BUFZ).

The first two funds offer exposure to the price performance of the SPDR S&P 500 ETF Trust (SPY) up to a cap while protecting against downside losses up to a certain percentage whils the last one invests in the 10 ETFs in First Trust’s family of “Moderate Buffer” ETFs. businesswire

ASIA-PACIFIC

Australia’s Betashares has launched a platform for do-it-yourself retail investors that it says will allow them to build tailored portfolios with low fees.

Betashares Direct enables investors to invest in any ETF listed on the Australian Stock Exchange and has an “autopilot” feature where they can set up recurring investments, tap into diversified portfolios and construct bespoke ETF portfolios, the firm says.

The new platform will not charge investors a brokerage fee. smsmagazine

The first Saudi Arabia-focused ETF is set to be launched on HK exchange by CSOP Asset Management.

The fund will track the Middle Eastern nation’s 50 largest firms, including state-owned oil giant Aramco, and will also invest across a diverse range of sectors spanning finance, energy and raw materials. scmp

A weekly podcast series focused on exploring the career journey of industry leaders within the ETF and Digital Assets space. Get to hear their personal story and be inspired.

This week we hear from Martijn Rozemuller, head of Europe at VanEck Europe. Listen to him HERE.

Flows

Net inflows of US$16.30 billion into the ETFs industry in Asia Pacific ex Japan during September, reports ETFGI:

- ETFs industry in Asia Pacific ex Japan gathered net inflows of $16.30 Bn during September.

- YTD net inflows of $119.56 Bn are the highest record, the second highest recorded YTD net inflows are of $92.13 Bn for 2022.

- 27th month of consecutive net inflows.

- Assets of $698 Bn invested in ETFs and ETPs listed in Asia Pacific (ex-Japan) at end of September.

- Assets increased by 20.6% YTD in 2023, going from $578.72 Bn at end of 2022 to $698.07 Bn.

Chinese ETFs record US$2.4B in net flows last week after a major state-controlled investor announced its purchase of ETFs and plans to keep jacking up its holdings. ignites

Noteworthy

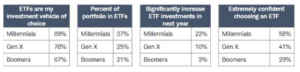

Millennials have fallen in love with ETFs, and the contrasting markets over the past two years haven’t damped their enthusiasm for investing.

According to the latest edition of the “ETFs and Beyond” report from Charles Schwab Asset Management, investors between the ages of 27 and 42 have emerged as the sweet spot for exchange-traded funds. schwabassetmanagement

The Financial Conduct Authority (FCA) will introduce the Overseas Fund Regime (OFR) in April 2024, removing a key post-Brexit barrier for new EU-domiciled ETFs when entering the UK.

OFR is the long-term legal framework that will enable fund platforms – predominantly in Ireland and Luxembourg – to be recognised by the FCA and market and distribute their products to all levels of UK investors. etfstream

The market continues to salivate on the prospects of the approval of a spot Bitcoin ETF in the US with Bitcoin rising to 17-month high as ETF optimism soars. ft

Issuance of new ETFs in the U.S. is on track to hit a record high in 2023, as asset managers rush to launch actively managed funds in response to rising interest rates and market volatility.

As of last week, Morningstar Direct calculated that 391 new ETFs had begun trading in 2023. That’s significantly higher than the 311 that had debuted by the final week of October in 2021, the year ETF launches set a record of 475. reuters

Movers and Shakers

Darnel Miller has been appointed Americas Head of ETF Capital Markets (Canada and Latin America) at Vanguard.

James Harrison has been appointed ETF Portfolio Manager & Capital Markets at The TCW Group.

From behind the Desk

The ETF Stream awards have been announced and delighted to see that we have been nominated for this year’s ‘ETF Educational Content of the Year’ award.

We are up against JP Morgan, BNY Mellon and Coinshares, so it should be a fair fight. They are only about ten thousand times bigger than us, but we like being the underdog.

On a serious note, producing content (like this newsletter) and trying to do our bit to educate the market is something we are really passionate about, so it is nice to see that recognised in some way. etfstream