Lessons from Taylor Swift and ETFs

Did you know Taylor Swift started writing songs at 16 years of age, which means she has spent 18 years honing her craft.

Vanguard launched the first index fund in 1976, which means they have had a few years to hone their craft as well.

So, why as an industry do we think when a new ETF manager launches, they are going to achieve immediate success?

Sure, sometimes you can be in the right place at the right time, but luck has a way of equalling itself out.

It takes time to achieve success and ultimately consistency always trumps talent.

Fund Launches and Updates

EUROPE

Amundi has launched Europe’s lowest-fee ETF capturing developed and emerging markets, with fees of less than half of its closest competitor. The Amundi Prime All Country World UCITS ETF (WEBG) is listed on Deutsche Boerse with a TER of 0.07%.

DWS has launched Europe’s first MSCI World ex USA ETF. The Xtrackers MSCI World ex USA UCITS ETF (EXUS) is listed on the Deutsche Boerse with a TER of 0.15%.

Lunate Capital, an Abu Dhabi-based asset manager is set to expand its range of ETFs with the launch of a United Arab Emirates fixed income ETF. The Chimera JP Morgan UAE Bond UCITS ETF will list on the Abu Dhabi Securities Exchange on 26 March with a TER of 0.50%.

Cboe UK will start accepting applications for crypto Exchange Traded Notes (ETNs) following the Financial Conduct Authority (FCA) approving professional investor access earlier this week.

The exchange will become the second in UK to accept bitcoin and ethereum ETNs, joining the London Stock Exchange (LSE) after the FCA gave the greenlight on 11 March.

AMERICAS

BlackRock is rolling out two new exchange-traded funds that use option strategies. The new funds will use a covered-call strategy on U.S. equities, with the iShares S&P 500 BuyWrite ETF IVVW focused on large-cap stocks and the iShares Russell 2000 BuyWrite ETF IWMW targeting small-cap.

iM Global Partner and Polen Capital have teamed up to launch two active, high-conviction international growth ETFs. The Polen Capital International Growth (PCIG) and the Polen Capital China Growth (PCCE), were launched on the NYSE.

BondBloxx has partnered with Income Research + Management (IR+M) to launch the BondBloxx IR+M Tax-Aware Short Duration ETF (NYSE Arca: TAXX). TAXX is actively managed and possesses a net expense ratio of 0.35%. Additionally, the fund utilizes a fixed income strategy that prioritizes after-tax income.

Pimco has proposed its first mutual fund-to-ETF conversion, according to a regulatory filing. The firm has proposed to its board of trustees for Pimco Funds that it consider converting its $141mn Mortgage-Backed Securities Fund from a mutual fund into an ETF, the filing states.

ASIA

Strong inflows into money market funds and ETFs helped funds domiciled in Hong Kong post net inflows of US$11.13B last year, up more than 90% year on year. equities and mixed-asset mutual funds both suffered more than US$2 billion in net outflows, the highest redemptions across both categories in five years.

PineBridge China JV ETF becomes first to surpass Rmb200B milestone. (US$27.8 billion) .The Huatai Pinebridge CSI300 ETF attracted Rmb1.6B in inflows on Tuesday alone, amid continued state-backed buying of equities ETFs.

A podcast series focused on exploring the career journey of industry leaders within the ETF and Digital Assets space. Get to hear their personal story and be inspired.

This week we hear from Amanda Rebello, Head of Xtrackers Sales, US Onshore at DWS Group. Click HERE to listen to Amanda.

Flows

Investors pulled a record $533mn from European-domiciled thematic ETFs in February, according to data from ETFbook. The withdrawals added to the gloom from a poor 2023, when the sector bled $1.1bn, the first annual outflow after at least a decade of net buying.

The numbers would have been worse still without the allure of artificial intelligence, however. Four of the top six thematic funds by inflows in the first two months of 2024 were AI vehicles.

Flows into emerging market equity exchange traded funds marked a new record in February, as activity by China’s “national team” appeared to continue at pace.

EM equity ETFs sucked in $28.2bn, an increase of more than 20 per cent on the previous record set in January of $23.3bn and a third of the $85.5bn in total captured by equity ETFs globally during the month, according to BlackRock.

Vanguard’s European ETF business has recorded its highest monthly net sales in more than four years, as the firm benefits from growing appetite for low-cost solutions and a lack of active fund outperformance, experts say.

The firm’s Europe-domiciled ETFs had net inflows of €2.4bn in January, their best monthly sales since December 2019, when Vanguard posted €2.5bn of net sales in European ETFs. Vanguard’s ETF business has grown 37 per cent to €114.6bn in assets under management in the 12 months to January 2024, according to Morningstar data

Noteworthy

The UK’s financial regulator will allow the sale of crypto asset exchange traded notes to professional investors but is maintaining its ban on retail investment.

The Financial Conduct Authority announced that it will not object to requests from exchanges to list ETNs backed by crypto assets, as long as they meet listing requirements and have sufficient control.

The market for bitcoin ETFs is likely to eclipse that of gold ETFs and break $97 billion, thanks to a surge of inflows and bitcoin’s soaring price valuation, according to Bloomberg senior ETF analyst Eric Balchunas.

Invesco has celebrated the twenty-fifth anniversary of the launch of the Invesco QQQ, its giant Nasdaq 100 ETF and the flagship fund of the Invesco QQQ Innovation Suite.

Introduced on 10 March 1999, QQQ has become the fifth-largest ETF globally, with approximately $250 billion in assets under management, and has one of the longest performance histories available in an ETF.

JPMorgan Asset Management aims to increase assets in its ETFs to $1 trillion (€919bn) within five years – more than six times the size of its current ETF business of $160bn.

George Gatch, chief executive officer of the $3.1 trillion asset manager, says the growth of the ETF market is “one of the most fundamental changes” the industry is going through.

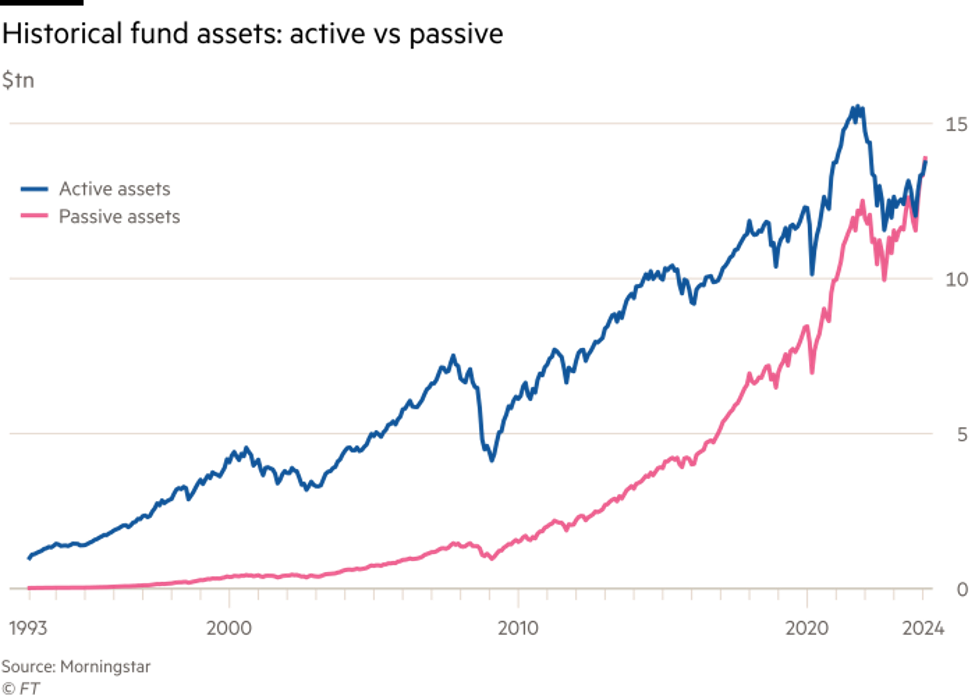

Assets in US index-trackers now outstrip those in stock selectors as investors opt for a smoother ride.

Movers and Shakers

Fabio Cuetara has joined Capital Group as Capital Markets specialist.

JPMorgan has hired Jon Maier as its chief ETF strategist, following his recent departure from Global X.

Fidelity International has appointed Andrea Semino as ETF and index sales director for Italy from Credit Suisse Asset Management.

HANetf has appointed David O’Neill as EU CEO.

Stephanie Ramezan has left her position as Head of UK at Gemini.

ETC Group has appointed Ronald Richter as director of investment strategy and Wendy Langridge as chief regulatory officer.

From behind the Desk

At the start of this newsletter, we mentioned consistency always trumps talent.

Now talent maybe is something we have rarely been associated with but we are consistent. In fact, when it comes to this newsletter we are into the 4th year now. That means writing and publishing this little document every week for 4 solid years.

Ever week, week after week we have been banging this out in the knowledge that probably only 30% of the audience (at best) ever bother open the email.

Heck! we don’t even get paid for it, it’s purely for the love and trying to add a little bit of value.

So, if you are reading this, please do us a favour and share it with someone and help us spread the love.

About us

Blackwater is a leading global ETF Consulting, Recruiting, PR and Content Creation firm.

We are specialists in helping companies find the best strategy to enter and navigate the ETF marketplace, enhance their reputation, craft innovative and engaging targeted ETF content and source the very best of talent across the ecosystem.

If you would like to discuss any of the above then please reach out at mike@blackwatersearch.com