How to achieve success in the ETF game

We thought were were about to become the next Tim Ferris when we launched our first podcast, Exchange Traded People over a year ago, but we think we ended up becoming more Ferris Bueller, unfortunately.

We guess part of the reason is not many people actually know we have a podcast, which never really helps the viewer numbers. But anyway, God loves a trier and so we are back with a new Podcast: ETF SUCCESS STORIES.

More details below, but the first episode is out now featuring the Co-Founders of BondBloxx and it’s pretty cool if you ask us.

Getting the inside story of what it takes to succeed in the ETF industry should spark the interest of everyone, so we hope you take the time to check it out. Plus, lots of great more interviews to come.

Fund Launches and Updates

EMEA

Fineco Asset Management has expanded its range of ETFs to 16 with the launch of five products including artificial intelligence and clean energy strategies. The ETFs, which include four thematics and a Japanese equity fund – all track MarketVector indices and are listed on the Euronext Milan with total expense ratios (TERs) of 0.38%. Link

White-label ETF issuers HANetf and Tidal Financial Group have partnered to promote each other’s services across Europe and the US. Under the agreement, Tidal will promote HANetf’s white-label offering for UCITS ETFs, exchange-traded commodities (ETCs) and exchange-traded notes (ETNs) in Europe to its US client base. In return, HANetf will promote Tidal’s white-label service for issuing ’40-Act’ and ’33-Act’ ETFs in the US to its European clients and network. Link

CoinShares has secured the exclusive option to acquire Valkyrie Funds, the ETF unit of its United States competitor, Valkyrie Investments, which includes the Valkyrie Bitcoin Fund awaiting U.S. approval. CoinShares said that the move helps it expand to the U.S., which could soon become the epicentre for ETF offerings. Link

AMERICAS

DWS has introduced a new thematic equity ETF targeting companies developing key technologies that support the interests of the US and its allies . The Xtrackers US National Critical Technologies ETF (CRTC US) has been listed on NYSE.

The fund offers an unexplored investment approach, combining industry-level screening with a geo-strategic risk rating score that measures a potential constituent’s entanglement in countries deemed risky by the US government. The fund, which has an expense ratio of 0.35%, is part of DWS’ broader rollout of thematic ETFs, the first three of which launched earlier this year. Link

Fidelity announced the launch of six new active ETFs that previously traded as mutual funds. The suite includes small-, mid-, and large-cap equities, as well as an international fund, and expands Fidelity’s lineup to 64 ETFs. The enhanced ETFs will have expense ratios ranging from 0.18% to 0.28%. Link

GMO, the $60 billion Boston-based investment firm founded by Jeremy Grantham, has launched its first ETF, an active fund that taps into the firm’s flagship strategy of investing in high-quality US equities.

The GMO US Quality ETF (QLTY US) has been listed on NYSE Arca with an expense ratio of 0.50%. QLTY was brought to market through the Goldman Sachs ETF Accelerator, a digital platform that enables Goldman Sachs’ clients to quickly and efficiently launch, list, and manage their own ETFs. Link

SoFi has launched its latest ETF, the SoFi Enhanced Yield ETF (NYSE Arca: THTA), on the New York Stock Exchange. THTA seeks to generate income by combining a strategy of holding short-duration U.S. Treasuries with a “credit spread” option strategy to generate enhanced yield. The ETF charges a TER of 0.49%. Link

Fidelity Wants to Create an Ether ETF according to a Friday filing, joining rival BlackRock in strengthening its crypto embrace. The Fidelity Ethereum Fund would be listed by an exchange owned by Cboe Global Markets. Link

Samsung Asset Management and Amplify ETFs have launched the first actively managed product in the U.S. to track a benchmark for interest rate risk and borrowing costs in the U.S. The Amplify Samsung SOFR ETF aims to produce a higher monthly return and total return than cash without resulting in a material increase in duration risk. Samsung AM will sub-advise the new ETF, which carries an expense ratio of 0.2%. The Korean asset manager acquired a 20% stake in Amplify ETFs last year. Link

ARK Invest and 21Shares become the first manager to reveal a fee for their spot Bitcoin filing unveiling an 0.80% fee. Link

ASIA-PACIFIC

J.P. Morgan Asset Management has launched its first smart beta ETF in China, the JPMorgan S&P HK Equities Low Volatility Dividend ETF. JPMAM is currently the only foreign firm with a wholly owned business that has ETFs listed onshore in China, but only has a small line-up of passive ETF strategies launched in the past three years that have not yet managed to attract significant flows or win local market share. Link

Dimensional Fund Advisors has launched its first-ever ETFs listed in Australia, entering a fast-growing market that is attracting a growing list of global players. The firm’s three actively managed Australian Core Equity, Global Core Equity (Unhedged) and Global Core Equity (AUD Hedged) were rolled out with a “dual-access” structure under which investors can access a fund through both listed and unlisted distribution channels. Link

Ever wondered what makes people decide to launch their own ETF business, the story behind their success or how they perceive their own success?

These are just some of the questions we dive into in our new podcast ETF SUCCESS STORIES.

This first episode features BondBloxx where I am joined by Co-Founders Leland Clemons and Tony Kelly who share lots of insights around the BondBloxx story. Click HERE to listen to them.

Flows

US Mutual funds had $80 billion in net outflows in October, while ETFs had $30 billion in net inflows according to Morningstar data. Morningstar’s data shows mutual funds, at more than $26 trillion, still make up about 70% of the combined mutual fund and ETF assets, meaning mutual funds aren’t going away anytime soon, but the trends are difficult to ignore. Link

Assets in Australia’s exchange-traded fund industry fell in October despite the second highest monthly net inflows so far this year, according to Betashares. The local ETF provider says in its Australian ETF review for October that the industry enjoyed “robust inflows” of A$1.8 billion (US$1.17 billion) last month, but that these net sales “were not enough to combat a decline in asset values” amid weakening global stock markets. Link

Noteworthy

The European Fund and Asset Management Association (Efama) has released a new issue of its Market Insights series, focusing on the European ETF market.

Titled “Ucits ETFs: A growing market in volatile times,” the report examines the main trends in the ETF market and the potential benefits of an EU consolidated tape. According to the paper, the ETF market in Europe has reached a total asset value of €1.4 trillion as of the end of 2022, indicating substantial growth in the ETP sector over the last five years. Link

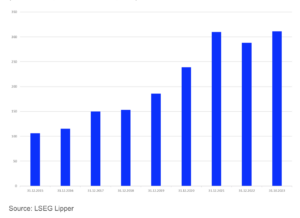

The number of European domiciled ETFs with more than €1.0 billion in assets under management has significantly increased since 2015 according to data from LSEG Lipper. Link

Movers and Shakers

Luis Berruga has been replaced as CEO of Global X by Thomas Park who will act as interim CEO.

State Street Global Advisors (SSGA) has named Ann Prendergast as head of its business across EMEA.

Marc Faubeau has joined Jacobi AM as Business Development Director.

Close Brothers Asset Management has promoted Weixu Yan to head of passives.

From behind the Desk

This week is Thanksgiving, which means all our US friends will be logging off sometime Wednesday afternoon to start thinking about their turkey lunch on Thursday. Yummy.

Happy Thanksgiving all.