Competition in the Metaverse space heats up

Trifecta of Metaverse ETF launches in Europe along side a slew of other thematic products. And in the U.S., Vanguard’s ETF assets are nipping at the heels of rival BlackRock.

Fund Launches and Updates

EMEA

DWS (effective 10 October), is set to transition its Luxembourg-domiciled ETF range to the ICSD model, aligning it with the rest of the Xtrackers range. ETF Stream

DWS has also launched the Xtrackers India Government Bond UCITS ETF (XIGB) on the Deutsche Boerse with a total expense ratio of 0.38%. ETF Stream

ETC Group is launching the ETC Group Physical EthereumPoW (ZETW) this month and will be listed on the Deutsche Boerse. ETF Stream

Franklin Templeton launched the Franklin Metaverse UCITS ETF3 (FLRA) which has been listed on the Xetra, the Borsa Italiana and the LSE. TER of 0.30%. Fintech & Finance News

Global X ETFs launched the Global X Disruptive Materials UCITS ETF (DMAT) which has been listed on the LSE, Xetra and the Borsa Italiana.TER of 0.50%. Investment Week

Invesco has launched the Invesco Wind Energy UCITS ETF (WNDE) and the Invesco Hydrogen Economy UCITS ETF (HYDE). Both are listed on the LSE, Xetra, Borsa Italiana and Six Swiss Exchange with a TER of 0.60%. ETF Stream

Legal & General Investment Management (LGIM) has launched: the L&G Metaverse ESG Exclusions UCITS ETF (MTVR), the L&G Optical Technology Photonics ESG Exclusions UCITS ETF (LAZG), the L&G Emerging Cyber Security ESG Exclusions UCITS ETF (ESPY) and the L&G Global Thematic ESG Exclusions UCITS ETF (THMZ).

All four are listed on the LSE, Borsa Italiana, Deutsche Boerse and Six Exchange. Citywire

VanEck has launched the VanEck Genomics and Healthcare Innovators Ucits ETF which has been listed on the London Stock Exchange and the Deutsche Börse, TER of 0.35%. Citywire Selector

Also VanEck is switching the indices on its three multi-asset ETFs to ones that include ESG metrics. ETFs impacted include: the VanEck Multi Asset Conservative Allocation UCITS ETF, the VanEck Multi Asset Balanced Allocation UCITS ETF and the VanEck Multi Asset Growth Allocation UCITS ETF. ETF Stream

Hashdex announced that the Hashdex Nasdaq Crypto Index Europe ETP is now tradable on the Euronext Paris and Euronext Amsterdam. EIN News

AMERICAS

Neuberger Berman is planning to convert its only US commodity mutual fund into an ETF, according to regulatory filings.

The $233 million Neuberger Berman Commodity Strategy Fund (NRBAX) is set to become an active, fully transparent ETF in the fourth quarter of 2022 joining a slew of other firms who have made similar conversions (MF to ETF). Wealth Management

Defiance recently launched the Defiance Daily Short Digitizing the Economy ETF (IBIT) which enters short positions of the Amplify Transformational Data ETF (BLOK). Businesswire

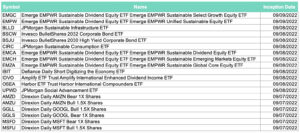

Full list of U.S. launches:

Flows

According to BlackRock, global ETP flows were slightly higher in August, with $49.4 billion added, up from $46.9 billion in July.

Equities added $29.7B added while fixed income inflows brought in $23.2 billion globally. Commodity outflows tempered from July’s record levels, with $4.5 billion of selling in August. ETF Express

Vanguard led the US industry in ETF flows last month taking in $24.2bn in August, nearly four times as much as iShares, which attracted just $6.2bn.

Vanguard’s S&P 500 ETF logged the industry’s second-best flows, at $3.6bn, behind State Street Global Advisors’ Financial Select Sector SPDR ETF’s $3.8bn.

Charles Schwab had the third-best flows, with $3bn, followed by Dimensional Fund Advisors with $1.9bn; SSGA with $1.8bn; and First Trust, with $1.7bn.

Among the other top 10 providers, ProShares had $1.3bn in inflows; WisdomTree, $700mn; Invesco, $200mn; and JPMorgan Asset Management, $100mn. Industry-wide, U.S. listed ETFs posted inflows of $43.8bn. Financial Times

Noteworthy

Vanguard vs. Blackrock

The FT had a lot of coverage of Vanguard last week and seems particularly excited to watch the race as Vanguard supposedly is closing in on BlackRock’s dominance within the States.

US ETF assets under Vanguard’s management totalled $1.84tn at the end of August, compared with the $2.21tn run by BlackRock’s iShares ETF unit bringing their control to over 60% of the US ETF market.

It’s important to note that globally, BlackRock has $2.96tn in worldwide ETF assets compared to $2.04tn for Vanguard at end of July. A gap of close to $1tn is a lot harder to catch. Financial Times

Active ETFs in Europe double

Morningstar data shows that assets held in actively managed ETFs in Europe have more than doubled since 2018, rising from €7.4 billion to €16.0bn at the end of July 2022.

Yet active ETF assets account for just 1.2% of the €1.3 trillion European ETF market, suggesting a significant opportunity for further growth. ETF Strategy

Surge in US-listed ETF launches

273 ETF launched through the end of August 2022 in the U.S., exceeding the number of launches during the same period in previous years.

This year’s growth has in part been driven by the boom in single-equity ETFs which debuted in July in the States and have been available for years in Europe.

While officials at the US Securities and Exchange Commission issued warnings about the risks of such products, at least 17 have already listed and more than 200 more have been proposed. Bloomberg

Additional reads

21Shares parent company secures $25m in funding round brining the firm valuation to $2bn. ETF Stream

Two months into the launch of the new ETF connect scheme between China and Hong Kong, trading volumes in the four Hong Kong-listed ETFs traded by mainland investors via the ETF Connect hit HK$8.16bn ($1.04bn) in August, increasing by almost 90% from the HK$4.31bn achieved in the previous month. Financial Times

Pension funds seek free lunch when investing in ESG ETFs, survey finds. ETF Stream

From behind the desk with Andrea Murray

There were a slew of thematic ETF launches in Europe last week with a whopping 3 new Metaverse ETFs.

Joining the likes of ETC Group and Roundhill, Fidelity International, LGIM and Franklin Templeton all launched metaverse ETFs within a day of each other.

From a Franklin Templeton press release, Caroline Baron, Head of ETF Business Development, EMEA, commented: “The metaverse is expected to grow to $5 trillion in value by 2030”, which makes sense why globally we are seeing a number of launches within this space.

A U.S. based-firm, VettaFi reminded us the word Metaverse has been around for years, originating in the 1992 novel Snow Crash.

Fast-forward past the hideous fashion decade of the 90s to Facebook rebranding itself as Meta, the term Metaverse overnight became a more mainstream concept. Please just tell me that the metaverse goggles go the same route that the 90s overalls trend should have gone – in the bin or at lease less bulky.

Available in Europe now:

And a fun fact about the METAVERSE – aside from the goggles, immersive wearables may soon become mainstream such as haptic gloves which will allow users to feel things in the metaverse.

Not into the gloves or goggles? Haptic vests, pants, and other wearables which can gather real-time biometric data will be able to relay emotional state, stress level, and key health indicators. I guess something one would not wear in the presence of the in-laws.