The SEC to review revenue sharing in the U.S.

In the U.S., the Securities and Exchange Commission’s enforcement division, SEC has launched an investigation on revenue sharing between ETF issuers and intermediaries.

And a busy week of global ETF launches including the first spot Bitcoin and Ethereum ETFs to launch in Australia.

Fund Launches and Updates

EMEA

Amundi has launched the Amundi Global AGG SRI – Ucits ETF DR and Amundi MSCI AC Far East Ex Japan ESG Leaders Select – Ucits ETF DR.

Both ETFs are listed on the Deutsche Borse Xetra and are Article 8 compliant under SFDR. Citywire

Bitpanda has launched the Bitpanda Cardano ETC, Bitpanda Ether ETC, Bitpanda Polkadot ETC and the Bitpanda Solana ETC.

All four are listed on Boerse Frankfurt and Deutsche Boerse with TERs of 1.49%. ETF Stream Link

DWS has launched the Xtrackers Harvest MSCI China Tech 100 UCITS ETF (XCTE) which is listed on the LSE and the Deutsche Boerse with a TER of 0.55%. ETF Stream

ETC Group has launched the XRPetc – ETC Group Physical XRP (GXRP) in partnership with HANetf. The new ripple ETP is listed on the Deutsche Boerse with a TER of 1.95%. Etf Stream

First Trust has launched the First Trust Nasdaq Clean Edge Smart Grid Infrastructure UCITS ETF (GRID) which is listed on the London Stock Exchange and Deutsche Boerse with a TER of 0.70%. ETF Stream

Global X has launched the Global X Uranium UCITS ETF. The new ETF has been listed on London Stock Exchange in US dollars (URNU LN) and pound sterling (URNG LN) as well as on Deutsche Börse Xetra in euros (URNU GY). ETF Strategy

HANetf will be launching the Electric Vehicle Charging Infrastructure Equity UCITS ETF (ELEC) which will list on the London Stock Exchange, Deutsche Boerse and Borsa Italiana. TER of 0.65%. ETF Stream

HSBC Asset Management has launched the HSBC Europe ex UK Sustainable Equity UCITS ETF (HSXU) listed on the London Stock Exchange with a TER of 0.15%. ETF Stream Link

WisdomTree has launched the WisdomTree Battery Metals ETC (WATT) and the WisdomTree Energy Transition Metal ETC (WENT).

Both ETCs are listed on the London Stock Exchange, Borsa Italiana and Deutsche Boerse with total expense ratios of 0.45%. ETF Stream

AMERICAS

Matthews Asia has filed to launch a trio of active ETFs which will be a first for the firm. The filing lays the groundwork for the firm to launch the Matthews Emerging Markets Equity Active ETF, Matthews Asia Innovators Active ETF and Matthews China Active ETF. All three ETFs would come with management fees of 0.79%. Link

Principal Global Investors (effective July 15th) is planning to convert its largest ETF and five others into actively managed strategies.

The manager intends to overhaul the investment strategies of its $1.6bn Principal US Mega-Cap ETF, $771mn Principal US Small-Cap Multi-Factor ETF, $235mn Principal Value ETF, $86mn Principal Quality ETF, $71mn Principal Healthcare Innovators ETF and $27mn Principal Millennials ETF. FT

Roundhill Investments debuted the Roundhill Cannabis ETF (ticker WEED) on April 20 – a date widely regarded as a marijuana holiday – and apparently waited 8 months to get that specific date. Smart marketing. Bloomberg

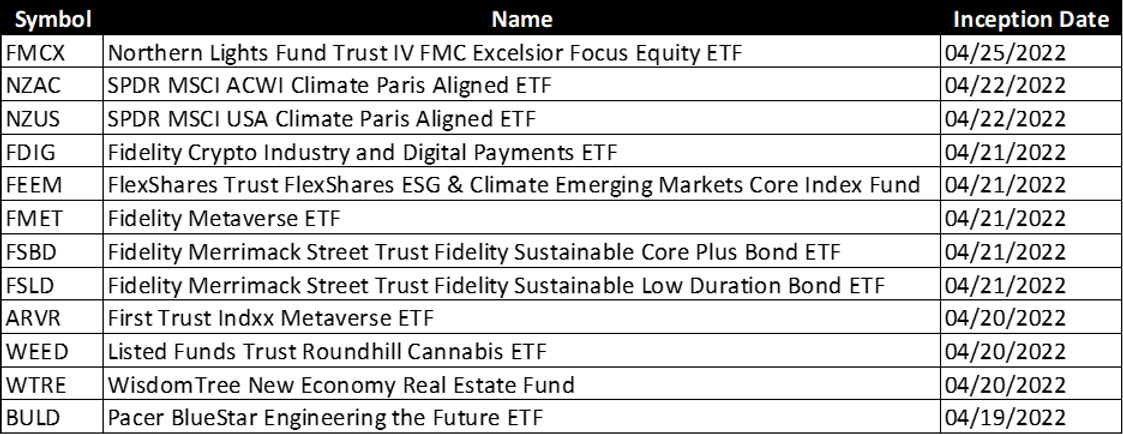

Full List of U.S. ETF Launches:

ASIA-PACIFIC

Coindesk, the highly anticipated spot crypto launches from 21Shares and ETF Securities and Cosmos Asset Management in Australia have been delayed 24 hours prior to launch.

Below are the expected products which have been delayed and awaiting word from the exchange. Coindesk

21Shares AG and ETF Securities are launching the ETFS 21Shares Bitcoin ETF and ETFS 21Shares Ethereum ETF in Australia. Both funds were expected to go live on April 27 and list on the CBOE Exchange (formerly Chi-X). PR Newswire

The Cosmos Asset Management’s Bitcoin ETF was also scheduled to be listed on the Australia Cboe equities trading platform on the same day.

The Cosmos fund invests in crypto through the Purpose Bitcoin ETF that listed on the Toronto Stock Exchange last November. Coindesk

Fund Flows and Trading Volume

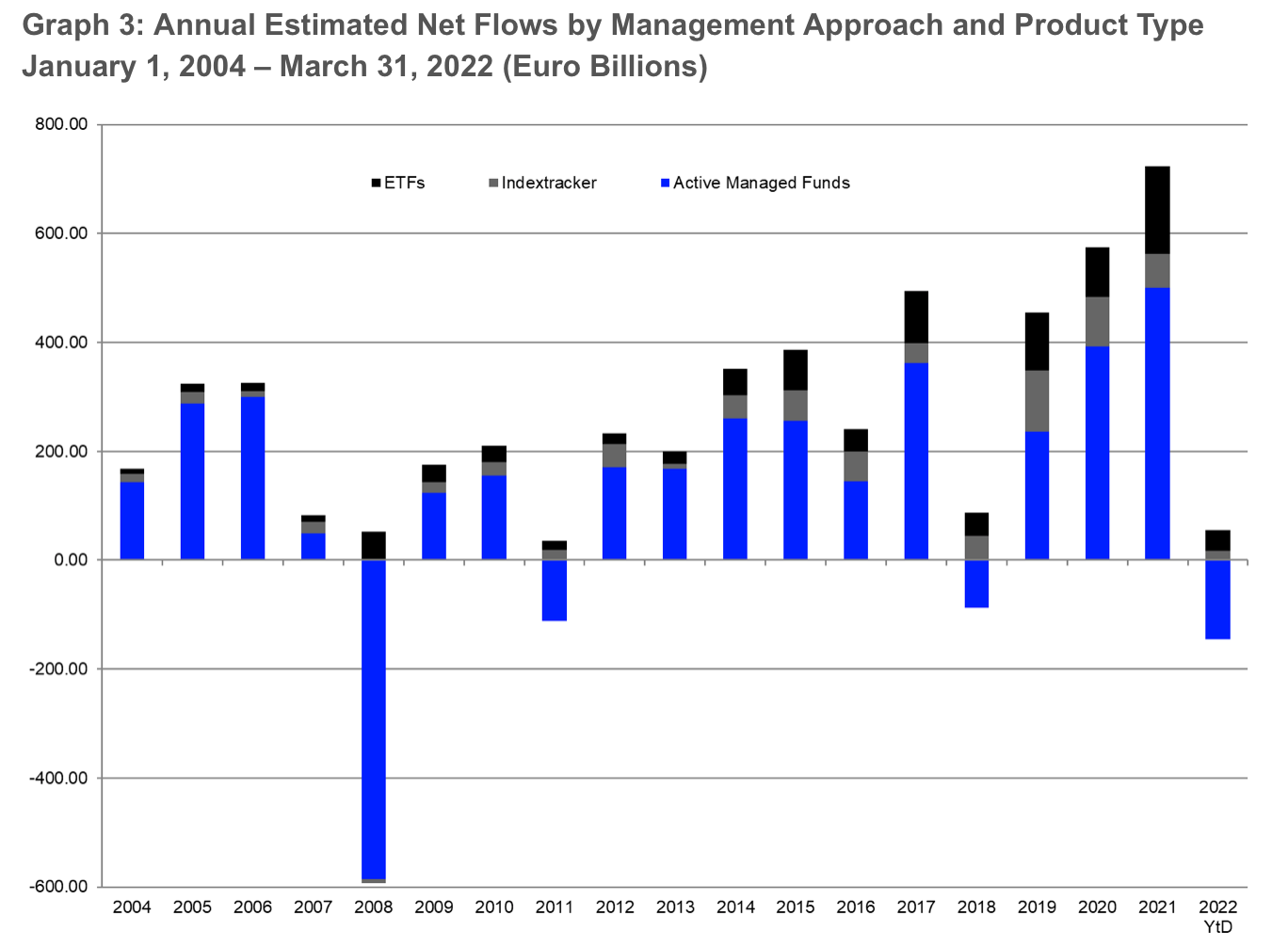

Detlef Glow reported quarterly ETF flows for Europe which saw an added +€38.3 bn outpacing the flows into passive index mutual funds of €17.6 bn through March 2022.

European ETF AUM increased to €1.33tn and equity ETFs posted the highest estimated net inflows in the European ETF industry with +€30.1 billion for Q1 2022.

The best-selling Lipper global classification for Q1 2022 was Equity US (+€10.1 billion), followed by Equity Global (+€10.1 billion) and Bond USD Government (+€4.4 billion).

Noteworthy

In the US, the SEC’s enforcement division has launched a sweep of ETF revenue-sharing practices.

According to the FT article, the SEC is requesting line-by-line details about revenue-sharing payments for each ETF and each intermediary.

Morgan Stanley Wealth Management, for example, said in a disclosure that it intended to charge revenue-sharing fees to sponsors of actively managed ETFs but not passive ones.

As the largest crypto asset manager in Latin America, Hashdex’s entry into the Swiss Crypto Valley will accelerate the company’s international reach.

The announcement builds on Hashdex’s ongoing international expansion as they actively recruit growing teams in London, Zurich, Paris, and Lisbon to support the firm’s global expansion. Global Newswire

Additional reads

AJ Bell launches its commission-free investment app for UK investors offering ETFs. ETF Steam

Grayscale puts further pressure on US SEC to approve spot Bitcoin ETF. Coinspeaker