Gold ETFs shine again after a rough 2021

Gold ETF products are seeing significant inflows as markets gyrate amid inflation concerns and rising geopolitical risks. And we are back to a long list of fund launches last week after a quiet start to the year.

Fund Launches and Updates

EUROPE

Already at its second launch of the year, 21Shares has expanded its crypto range with the launch of the 21Shares Cosmos ETP (ATOM). Listed on the SIX Swiss Exchange in Swiss francs, euros and US dollars, the fund has a total expense ratio of 2.5%. Link

Chimera Capital LLC has listed the Chimera S&P KSA Shariah exchange-traded fund in Abu Dhabi. The product will allow traders in the UAE to track Saudi stocks via a local bourse — a first for the Gulf’s ETF market. Link

As predicted in our 2022 ETF|Digital Assets Outlook report, more ESG switches have been announced.

Ossiam has added an ESG filter to the Ossiam STOXX Europe 600 Equal Weight UCITS ETF (S6EW) and will be renamed the Ossiam Stoxx Europe 600 ESG Equal Weight UCITS ETF. Link

ETC Group listed physically-backed Polkadot (Ticker: PLKA), Solana (Ticker: ESOL) and Cardano (Ticker: RDAN) ETCs on the SIX Swiss Exchange. Link

HANetf listed the Royal Mint Physical Gold Securities ETC (RMAU) on EURONEXT last week. RMAU first listed on the London Stock Exchange in February 2020 and is also listed on XETRA and Borsa Italiana.

iM Global Partner has launched two Ucits-compliant funds via its strategic partnership with US boutique Richard Bernstein Advisors. This will introduce Richard Bernstein’s ETF strategies to European investors for the first time under the ETF name, the iMGP Global Risk-Balanced fund and the iMGP Responsible Global Moderate fund. Link

Invesco has cross-listed its directly backed bitcoin ETP into the Swiss market. The Invesco Physical Bitcoin ETP is available to trade on SIX Swiss Exchange in US dollars under the ticker BTIC SW. Link

Effective in March, Vanguard is proposing to change the screening criteria on five products in its passive ESG range to remove inconsistencies from its exclusion methodology. Full details here.

AMERICAS

Invesco Canada Ltd. announced the launch of eight new ETFs that expand its ESG offerings. Link

In Brazil, crypto asset manager Hashdex reported that the first decentralized finance ETF in the South American nation was approved.

The financial instrument will begin trading on the Brazilian Stock Exchange on February 17. Link

Blackrock has filed an application with the Securities and Exchange Commission for a blockchain tech ETF.

The Ishares blockchain tech ETF aims to track the Intercontinental Exchange (ICE) index called the Factset Global Blockchain. Link

ASIA-PACIFIC

In China, the newly launched Yinhua Fund Management’s CSI Modern Logistics ETF was listed on the Shanghai Stock Exchange.

This comes seven months after the country’s first supply chains thematic product, the Fullgoal Fund Management’s CSI Modern Logistics ETF, was launched in June last year. Link

Flows

In Australia, a record breaking $42 billion of growth brought the ETF sector past $137 billion last year and was dominated by the top three players – Vanguard, BetaShares and iShares.

The top three players accounted for 75% of the $23.2 billion of inflows.

Over the course of the year, 33 funds launched of which 12 were active ETFs. Pretty sure that Australia is the only continent where SSGA is not listed within the top three. Good on BetaShares for making it to that coveted list. Link

On Friday, in a sign of market turmoil that are all not enjoying, SPDR Gold Shares recorded its biggest net inflow since listing in 2004 — worth $1.63 billion.

The start of the year has been bumpy and rising geopolitical tensions are driving some investors back to bullion as a safe haven. Last year, the SPDR gold ETF posted its biggest annual outflow in tonnage terms since 2013. Link

Last week saw the biggest weekly inflows since April 2021 as investors poured $1.98 billion of fresh investment into Chinese assets, helping push total inflows to $2.98 billion.

The inflows to China were led by the $7.4 billion KraneShares CSI China Internet Fund (KWEB). The fund brought in $793 million in the week, the most since August. Link

Another 2022 outlook prediction from our report – active manager conversions are proving to be fruitful as Dimensional Advisors exceeds $46 billion in active assets since November.

Dimensional also launched a new (non-converted) active fixed-income ETF which has almost $1 billion in assets since their inception in November. Link

Noteworthy

Europe based white label provider HANetf will be working with Mexican broker Casa de Bolsa Finamex SAB de CV to launch their first European UCITS ETF.

Both firms commented that the UCITS wrapper is gaining popularity in Latin America due its regulatory structure, as well as its preferential tax treatment of UCITS vehicles versus the ’40 Act’ structure. Link

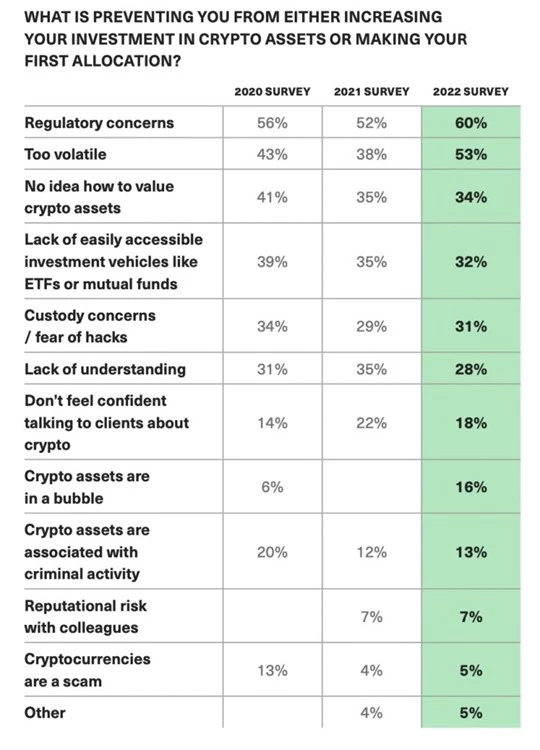

A joint report by Bitwise Asset Management and ETF Trends found that 94% of financial advisors in the U.S. fielded crypto questions from their clients last year.

The survey included 619 responses from RIAs, broker-dealer reps and financial planners in the US and found that an additional 14% said they will “probably” or “definitely” have crypto holdings this year.

The report found that 82% of advisors said they’d prefer investing in a spot bitcoin ETF versus a futures-based alternative. Link

Tying into the above, Jane Street has been executing crypto trades since 2017 and has commented that the crypto trading business has been a ‘clear growth area’ over the past 16 months.

Institutional clients are increasing their interest as enquiries from private wealth and sovereign funds are more evident.

Additional reads

The switch to ESG indices has not pleased all European investors as some say

repurposing an ETF can affect the client relationship. Link

BlackRock, State Street Alums set plans to disrupt the Junk-Debt ETF space Link

The recently announced ETF link between the Singapore Exchange and Shenzhen Stock Exchange will not feature fixed income ETFs or REIT products. Link

Solactive launches indices for the Scotia Responsible Investing ETF suite Link

Conflicts of interest damage ETF model portfolios, research finds. Link

US investors shun currency-hedged ETFs despite outsized returns. Link