Alliance Bernstein finally arrives

A laundry list of ETF launches in the United States including long awaited entrant, Alliance Bernstein.

In Europe, the Central Bank of Ireland, CBI is said to be reviewing daily disclosure requirements which could fare well for active ETFs.

Fund Launches and Updates

EMEA

Amundi is set to expand its ETF business in Italy after signing an agreement with Italian bank and broker FinecoBank. The move will allow Fineco’s Italian clients to access a wide selection of ETFs from Amundi, which include ESG, climate, thematic and fixed income strategies. Funds Europe

EQONEX Limited, a digital assets financial services company, is expanding its product offering with the EQONEX physically backed USD Bitcoin ETN (Ticker: EQ1C) and has been listed on the Deutsche Börse XETRA. PRNewswire

WisdomTree has expanded its thematic range with the launch of the WisdomTree Blockchain UCITS ETF (WBLK). The new ETF is listed on Deutsche Börse XETRA, Borsa Italiana and the London Stock Exchange with a total expense ratio of 0.45%. ETF Stream

AMERICAS

Emerge Canada in Canada has launched the actively managed Emerge EMPWR Unified Sustainable Equity ETF (EMPW US) on the Cboe BZX Exchange.

Similar to the firm’s initial three sustainable ETFs in the US, Emerge’s newest fund forms part of the firm’s ‘EMPWR’ line-up, a suite of products sub-advised by women-led, third-party asset managers. ETF Strategy

In the US, AllianceBernstein – after hiring Noel Archard to lead the ETF team back in February – has finally joined the ETF party with their launch of actively-managed AB Ultra-Short Income ETF (ticker YEAR) and the AB Tax-Aware Short-Duration Municipal ETF (TAFI).

‘YEAR’ has an expense ratio of 0.25% and TAFI’s is 0.27%. Wealth Management

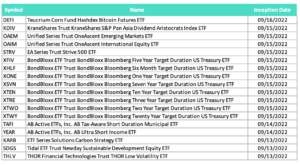

BondBloxx Investment Management has unveiled a suite of US Treasury ETFs delivering precise duration exposures.

Listed on NYSE Arca, the suite consists of eight funds targeting portfolio durations of six months and one, two, three, five, seven, ten, and twenty years. Full list included in the grid below. ETF Strategy

Carbon Collective, a Robo investment adviser which creates climate-focused 401ks, is the latest entrant to throw its hat into the ring of ESG ETFs.

According to Bloomberg news, the actively-managed Carbon Collective Climate Solutions U.S. Equity ETF is set to begin trading on Tuesday. Bloomberg

Hashdex, an asset manager specializing in cryptocurrency, announced the launch of the Hashdex Bitcoin Futures ETF (NYSE Arca: DEFI).

Developed with Teucrium Trading and Victory Capital Management, the ETF began trading on the NYSE Arca Friday, 16 September. VettaFi

Krane Funds Advisors launched the KraneShares S&P Pan Asia Dividend Aristocrats ETF (KDIV) to provide “exposure to companies in China, Japan, Australia, and other Asian countries that have paid and increased their dividends over a sustained period.”

Goldman Sachs Asset Management (GSAM) is planning to launch the following two ETFs in December, according to regulatory filings.

Goldman Sachs MarketBeta Total International Equity ETF and the Goldman Sachs ActiveBeta Emerging Markets Low Vol Plus Equity ETF bringing their total line-up to 33 ETFs. Citywire USA

Full list of U.S. launches:

ASIA-PACIFIC

More metaverse ETFs enter globally as Nikko Asset Management unveiled the NikkoAM Metaverse Theme Active ETF which is listed on the Hong Kong Stock Exchange and has ongoing charges of 1.25%.

ETF Securities in Australia has been officially rebranded as Global X ETFs after being acquired by Mirae Asset Financial Group and Global X in June. Financial Standard

Flows

Monthly flows are obviously not in yet so taking a look at the week, U.S.-listed ETFs brought in nearly $25 billion through Sept. 16 according to ETF.com data.

The net inflows mark a stark reversal from the prior two weeks, when funds shed $4.2 billion and $5.3 billion, respectively.

Most of the intakes stemmed from U.S.-listed equity funds, which alone brought in $20.2 billion, while U.S. fixed income funds saw $3.6 billion in gains last week, up 33% from the week prior. ETF.com

Noteworthy

Active ETFs in Europe

The Central Bank of Ireland, CBI, is considering reviewing its requirement for ETFs to fully disclose their daily holdings in a move seen as key to the growth of actively managed ETFs.

During a recent HANetf webinar, Stephen Carson, partner at A&L Goodbody, said the CBI had “expressed a desire to engage with market participants and to review the requirement”.

“We’re hopeful that in the not-too-distant future, maybe later this year, early next year, the central bank will hopefully revise its rules in a way that might make it possible to operate active ETFs on a semi-portfolio transparency basis”.

A much needed boost to the active ETF space in Europe if he is indeed right. Ignites

ETFs in Japan

Opinion is out that the Tokyo Stock Exchange’s, TSE foray into listing actively managed ETFs next year may do little to boost liquidity for a market faced with foreign outflows.

The TSE is planning to launch these ETFs in June as a way to stem thinning volumes and remain competitive against global peers.

One key hurdle for investing in Japan’s $419 billion ETF market is the central bank’s dominance in the space. About a decade ago, the Bank of Japan’s bold monetary experiment resulted in it owning a whopping 80% of the country’s ETFs. Japan Times

Additional reads

In Europe, demand for white-label servicing heats up. ETF Stream

In the States, a report found that 80% of investors say ETFs are their vehicle of choice, up from 71% in 2020.

The majority (93%) expect to purchase ETFs in the next two years, while 41% of non-ETF investors are also likely to do so, according to this report by Schwab. ETF Express

China’s securities regulator approved a batch of six tech-focused ETFs opening fresh capital channels into the battered sector. Nasdaq

From behind the desk with Andrea Murray

Thematic products in the US are going very narrow as Subversive Capital has plans to launch two new ETFs that will mirror the personal investment portfolios of US Congress members.

These products are clearly riding on the heels of Americans belief that politicians have an “unfair” edge in stock market trading due to their connections with lobbyists and access to what should be considered inside information.

Proof is in the stodgy pudding.

A January poll revealed 76% believe members of Congress and their spouses have an “unfair” edge in financial markets, with just 5% saying they should be allowed to trade.

There is even a US twitter account with the handle, @PelosiTracker_ that tweets whenever Nancy Pelosi or her husband’s portfolio changes.

Dirty politicians aside, the registered Subversive Capital ETFs have creative tickers which will most likely resonate with a retail crowd — ticker ‘NANC’ for the Unusual Whales Subversive Democratic Trading ETF and ticker ‘KRUZ’ for the Unusual Whales Subversive Republican Trading ETF.

I have a feeling Nancy Pelosi and Ted Cruz will not be investors. And side note – a bummer that ticker “CRUZ” was already nabbed. It would have been perfect.