The FCA to review index providers

The Financial Conduct Authority, FCA is planning to review competition law among index providers and every single ETF in the U.S. with the word “inflation” in the fund name saw inflows last year.

A record number of ETP launches last year and the smallest number of fund closures since 2014.

Fund Launches and Updates

EUROPE

21Shares has announced the listing of the world’s first crypto ETP on the Terra blockchain in CHF, EUR, and USD on SIX Swiss Exchange. Link

BlackRock is set to switch five sector ETFs to indices that implement reduced carbon and ESG metrics. As a result, all the ETFs will have ESG added to their name, remaining under the same ticker and total expense ratio (TER) of 0.25%. Link

DWS will be changing the index for the Xtrackers iBoxx USD Corporate Bond Yield Plus UCITS ETF (XYLD) from the Markit iBoxx USD Corporates 1-20 Year Plus index to the Bloomberg MSCI USD Corporate Sustainable and SRI 0-5 Years index. The ticker will stay the same and the TER will be reduced from 0.26% to 0.16%. Link

HANetf and EMQQ recently launched the FMQQ Frontier Internet & Ecommerce UCITS ETF (FMQQ) on the London Stock Exchange, Deutsche Börse, Borsa Italiana, as well as Euronext Paris. TER is 0.86% Link

HSBC Asset Management has launched the HSBC Bloomberg Global Sustainable Aggregate 1-3 Year Bond UCITS ETF (HAGG) on the London Stock Exchange with a total expense ratio of 0.18%. Link

Northern Trust Asset Management has launched the FlexShares Listed Private Equity UCITS ETF on the Euronext Exchange in Amsterdam with a TER of 0.40%. Link

AMERICAS

In Canada, Evolve Funds Group partnered with Solactive to launch the Evolve European Banks Enhanced Yield ETF on the Toronto Stock Exchange under the ticker symbol EBNK. Link

Flows

We all are aware at this point that the global ETF industry attracted record inflows of over $1tn in 2021 but perhaps overlooked has been the extraordinary growth in the breadth of products last year.

An overall total of 1,503 ETFs and ETCs were launched, ahead of the previous record of 873 recorded in 2018. Just 264 ETFs were closed, down from 510 in 2020 and the lowest figure since 2014. Link

In Singapore, the iShares USD Asia High Yield Bond ETF accounted for nearly three quarters of net inflows into all ETFs listed on Singapore’s stock exchange in 2021, bringing in S$2.94bn of last year’s overall net ETF inflows of S$4.04bn.

ETF assets listed on the Singapore Exchange climbed 47 per cent to $9.24bn at year-end. In second place, was the ICBC CSOP FTSE Chinese Government Bond ETF, which attracted S$316m in net new flows. The number of Singapore-listed ETFs rose from 30 to 35. Link

Noteworthy

The Financial Conduct Authority, FCA is looking into potential breaches of competition law after a consultation revealed that benchmark index prices have been increasing.

According to the respondents to an FCA’s consultation, multiple barriers to switching between benchmarks exist and the complexity of licensing terms makes it difficult to compare different index providers’ offers.

The UK’s financial watchdog will launch a market study on competition between benchmarks in the summer, including how benchmarks are priced, their contractual terms and barriers to switching. Sounds like a fun summer activity.

But really, how much lower can ETF fees go?

Sure, some areas like thematics have not entered the fee war as much as others but as benchmark providers said, “it is important that the pricing of benchmarks supports a sustainable benchmark business and reflects the investments providers make in innovation”. This goes for ETFs as well especially the smaller issuers. Link

Great LinkedIn post from Bloomberg’s Athanasios Psarofagis showing that ETFs are the preferred passive vehicle.

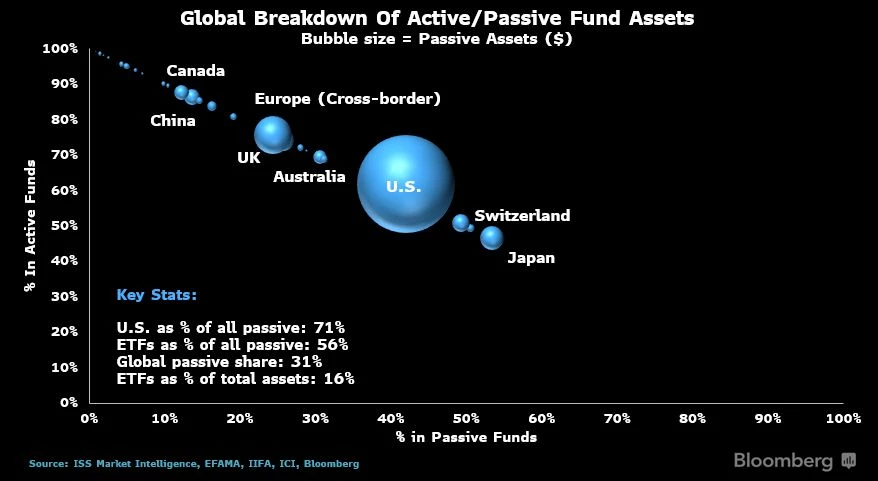

Looking at active and passive fund assets globally, passive funds make up 31% of all assets with $17trillion globally. Passive assets are mostly in the U.S, holding $12T. Country wise, Japan has largest % in passive funds (53%) thanks to the Bank of Japan, Switzerland (49%), and U.S (41%).

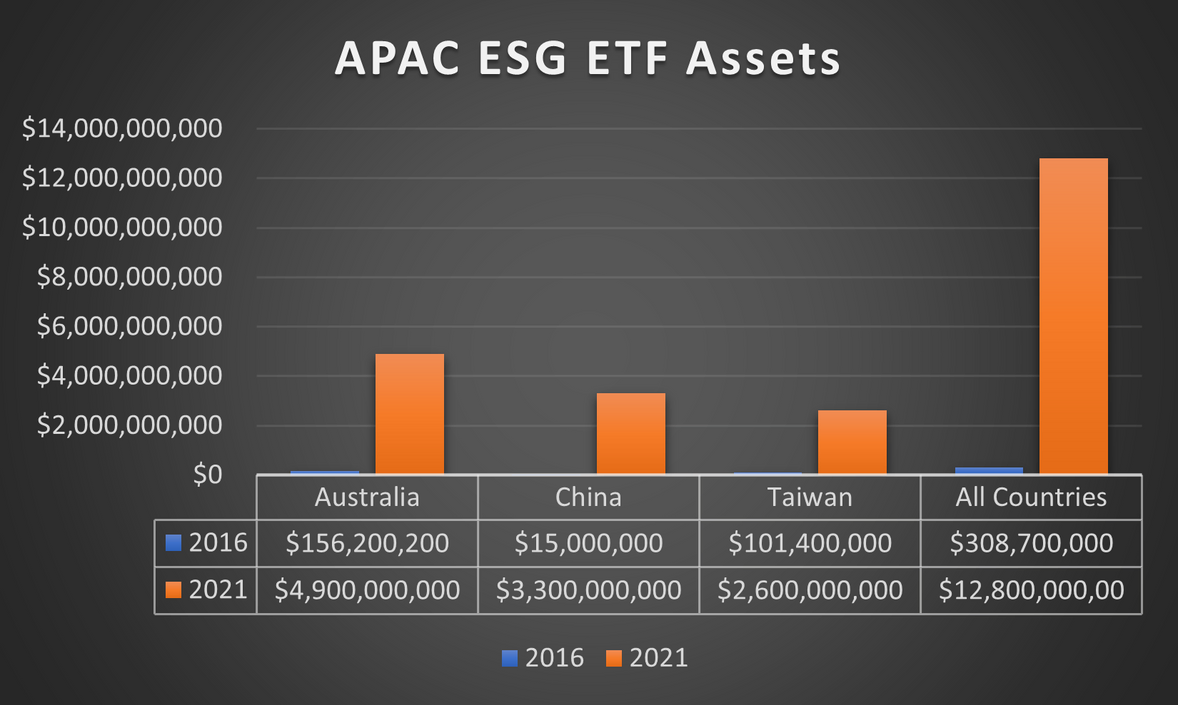

We usually focus on the popularity of ESG products in Europe but according to a recent Cerulli report, total ESG ETF AUM in AsiaPac grew from $308.7m in 2016 to $12.8bn as of June 2021.

Australia, China and Taiwan were the dominant regional players with 86.8 per cent of total ESG ETF assets in Asia Pacific in 2020. ESG ETF growth has been particularly strong in Australia which saw assets in the sustainable funds jump from $156.2m in January 2016 to $4.9bn in June 2021.

ETF Express summarised a European ETP trading report produced by Bloomberg’s Henry Jim and Athanasios Psarofagis showing that European ETP trading exceeded EUR2 trillion in 2021.

A quick summary from the report found that RFQ services via multilateral trading facilities handle the largest portion of Europe’s ETP trading. iShares has Europe’s deepest liquidity pool followed by Xtrackers and Europe’s 15 most traded ETPs accounted for 19% of volume in 2021.

And finally, ETP liquidity tends to be spread out among newer and older products in the European market, where trading is relatively fragmented. Link

Additional reads

Every ETF in the U.S. with the word inflation in the name saw inflows last year. Link

BlackRock assets hit record $10 Trillion, Powered by ETFs. Link

Thematic and ESG ETPs see numbers increase at the London Stock Exchange. Link

Vanguard fires fresh salvo in asset management fee war. Group to cut costs on investment funds by $1bn over next four years, chief executive Tim Buckley says. Link

Leverage Shares breaks LSE record for greatest listings in one day Link

BlackRock makes cuts to fees on $35bn in bond ETFs Link

ETF industry hits back at claim index rebalances kill returns Link