IS EUROPE ABOUT TO BAN INDUCEMENT FEES?

To us retrocession or inducement fees are the cancer of fund distribution in Europe (and Asia).

So we were very interested to see the comments last week from the European Commissioner for Financial Stability, who said the Commission is considering a ban on inducements as part of its retail investment strategy.

Great news, but why has it taken them so long?

Inducement or retrocession fees are screwing the retail investor across Europe and Asia and have been doing so for a very long time now.

How can anyone claim to provide “independent advice” if they are receiving a kickback on the products they are recommending?

That is a massive conflict of interest.

ETFs are wonderful investment tools for everyone, but most “advisors” don’t want anything to do with them simply because they don’t pay commission.

A ban on inducements would level the playing field and should give investors access to better choices. Surely that can only be a good thing.

Fund Launches and Updates

EMEA

Amundi has switched the index on its Japan equity ETF to one that tracks a Climate Transition Benchmark (CTB). etfstream

Amundi unveils climate-focused Euro corporate bond ETF. The Amundi EUR Corporate Bond Climate Net Zero Ambition PAB UCITS ETF has a TER of 0.14%. investmentweek

Ossiam expands Shiller range with global equity ETF.

The Ossiam Shiller Barclays Cape Global Sector Value UCITS ETF (EUPA) is listed on the Deutsche Boerse, Six Swiss Exchange, London Stock Exchange, Borsa Italiana and Euronext Paris with a TER of 0.65%. etfstream

AMERICAS

Panagram Structured Asset Management, a $13.5 billion credit asset manager and a subsidiary of Eldridge, announced the launch of its first ETF: the Panagram BBB-B CLO ETF (NYSE Arca: CLOZ).etftrends

Goldman Sachs Asset Management has converted its defensive equity strategy into the Goldman Sachs Defensive Equity ETF (NYSE Arca: GDEF) in its first mutual fund to ETF conversion etfstrategy

First Trust expands its target outcome ETFs line-up. etfexpress

Invesco plans ETF closure of 20 ETFs as it refines product lineup. etftrends

Ark 21Shares Spot Bitcoin ETF is rejected by SEC for the second time. Coindesk

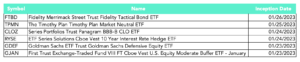

Full list of U.S. launches:

CLICK to listen stories from inspiring leaders. This week we speak with Marie Dzanis, Head of Northern Trust Asset Management EMEA.

Flows

ETF provider Pacer’s assets race past $20bn, Flagship COWZ fund AUM surged to $10.3bn at the end of 2022 from $1.3bn at the start of the year. FT

After receiving more capital inflows in January than all of 2022, the iShares Core MSCI Emerging Markets ETF (IEMG), is solidifying its position on Wall Street with $72.5 billion in managed assets and $4.1 billion in cash inflows year-to-date. foxbusiness

Index funds will control more than half of long-term invested US assets by the end of 2027, according to ISS Market Intelligence.

Active fund’s (Mutual Funds) share of the US market will fall from 53% in 2022 to 44% in five years according to their research meaning 56% of all funds will be passively managed by 2027. FT

Noteworthy

Are Inducement fees in Europe going to be banned?. ignites

SPY’s 30-year anniversary isn’t the only big ETF milestone in 2023.

This summer, a decade will have passed since Cameron and Tyler Winklevoss submitted the first filing for a bitcoin ETF, the Winklevoss Bitcoin Trust in the US. We hope no one is holding their breath for when it will actually happen. Etf.com

Crypto ETFs roar into life with eye-popping 2023 returns. The Valkyrie Bitcoin Miners ETF (WGMI) has led the way with a 101% return since the turn of the year, but a flock of rival funds have also chalked up gains of between 40 and 80 %.

The partial recovery has also been echoed by some technology funds, such as the Ark Innovation ETF (ARKK). It has risen 25 % so far this year. FT

Additional reads

Brieuc Louchard, Head of ETF Capital Markets at AXA talks about why the firm decided to get into the ETF game. video

Will ETFs exist in 30 years? Interesting article from ETF.com on this. Our guess is that ETF will not be around in 30 years as they will have been replaced by something else. What that is is anyone’s guess. ETF.com

Thought of the Day

Whilst all eyes were on SPY last week here are some interesting facts about where ETFs were born – Canada.

The First ETF 1990

The First Bond ETF 2000

The First leveraged ETF 2007

The First marijuana ETF 2017

The First currency hedged ETF 2016

The First Bitcoin ETF 2021

The First psychedelic ETF 2021

Canada is like the Michael Phelps of ETFs. Impressive