The crypto ETP world gets whiplashed

A quiet week for European ETF launches but not for the world of crypto ETPs which were rattled by the drama of the FTX fallout.

Fund Launches and Updates

EMEA

DWS has changed seven of its Xtrackers ETFs to ensure the indices are more closely aligned with the goals of the 2015 Paris Agreement. Citywire

The ETF names have been updated as follows:

Xtrackers II EUR Corporate Bond SRI PAB Ucits ETF 1D

Xtrackers II EUR Corporate Bond SRI PAB Ucits ETF 1C

Xtrackers II EUR Corporate Bond Short Duration SRI PAB Ucits ETF 1C

Xtrackers USD Corporate Bond SRI PAB Ucits ETF 1C

Xtrackers USD Corporate Bond SRI PAB Ucits ETF 2C EUR Hedged

Xtrackers USD Corporate Bond Short Duration SRI PAB Ucits ETF 1D

Xtrackers USD Corporate Bond Short Duration SRI PAB Ucits ETF 2C EUR Hedged

Fidelity International has launched the Fidelity Sustainable Global High Yield Bond Paris-Aligned Multifactor Ucits ETF. The fund, which brings Fidelity’s passive range to 18 products, was launched on the London Stock Exchange with a TER of 0.35%. Citywire

Wahed, a US-based ethical investing firm, has partnered with Leverage Shares to launch the Wahed FTSE USA Shariah ETP (HLAL) on the London Stock Exchange. ETF Stream

AMERICAS

In Brazil, Galaxy Digital, has introduced another BTC ETF in partnership with Itaú Asset Management, Latin America’s largest private asset manager. The IT Now Bloomberg Galaxy Bitcoin ETF (BITI11), began trading on B3 Stock Exchange. Tokenhell

In the US, AXS Investments launched the AXS Brendan Wood TopGun Index ETF (NYSE Arca: TGN) which includes approximately 25 companies representing the top 2% of companies in the Brendan Wood Shareholder Conviction Universe of more than 1,200 potential investment targets.

The launch of TGN is the latest in a series of ETF launches and acquisitions by AXS. VettaFi

BlackRock has launched the iShares Environmental Infrastructure and Industrials ETF (EFRA US) on the Nasdaq with an expense ratio of 0.47% ETF Strategy

DWS launched three ETFs that provide exposures to U.S. equities screened for ESG criteria. The new funds are the Xtrackers S&P ESG Dividend Aristocrats ETF (SNPD), Xtrackers S&P 500 Growth ESG ETF (SNPG) and Xtrackers S&P 500 Value ESG ETF (SNPV).

Innovator Capital Management announced the listing of the Innovator Equity Managed Floor ETF (SFLR), a fund that seeks to deliver U.S. equity upside and income potential, while limiting a shareholder’s potential for maximum loss through an options overlay.

Strive Asset Management debuted four new ETFs adding to their lineup of products that cater to the company’s “profits over politics” investment policy.

The new ETFs include the Strive 1000 Growth ETF (STXG), the Strive 1000 Value ETF (STXV), the Strive 2000 ETF (STXK) and the Strive 1000 Dividend Growth ETF (STXD). All four funds are listed on the Nasdaq. STXG, STXV and STXK come with expense ratios of 0.18%, while STXD charges 0.35%. Yahoo!Finance

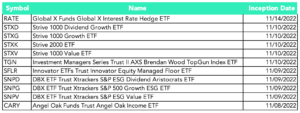

Full list of U.S. launches:

ASIA-PACIFIC

JPMorgan Asset Management has listed the JPMorgan Equity Premium Income Active ETF (Managed Fund) (JEPI) and the JPMorgan Global Research Enhanced Equity Active ETF (Managed Fund) (JREG) on the Australian Securities Exchange.

The firm reportedly plans to roll out more products in the Australian market. Private Banker International

Flows

We included global ETF flows in last week’s newsletter so instead of repeating stale data, we thought it would be helpful to include two of our favourite LinkedIn posts of the week.

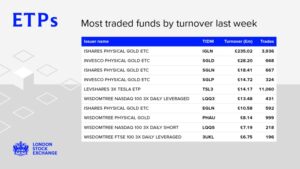

First, the London Stock Exchange posted the following chart showing WisdomTree Asset Management’s FTSE 100 3X Daily Leveraged ETP (3UKL) which topped last week’s Top 10 traded ETPs, followed by Invesco Ltd.’s Physical Gold ETC (SGLD).

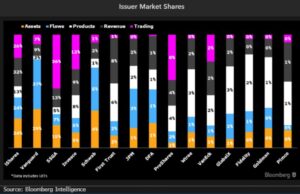

And our second post is from Bloomberg intel’s team which shows the breakdown of US ETF issuers market share of assets, flows, trading volume and that all important revenue.

Noteworthy

A Crypto earthquake

In the crypto space, I can imagine there were a lot of sleepless nights for the industry reminiscent of the 2008 volatility or in more recent times, the 2018 US Volmaggedon period when a number of Inverse VIX ETNs lost over 90% of its value in just over an hour’s trading.

We were there for both, not fun but did create opportunities to provide more education to willing listeners.

There are three ETPs in particular that that are invested purely in FTT and have just recently announced a suspension of creation activity:

the VanEck FTX Token exchange traded note (VFTX), the 21Shares FTX Token ETP (AFTT) and the CoinShares FTX Physical FTX Token ETP (CFTT). The three had combined assets of €27.7mn as of October 31, according to Morningstar data.

The fallout from the meltdown at FTX is also taking its toll on a series of other cryptocurrency ETPs, particularly those invested in Solana, which has tumbled 47% amid speculation that FTX will need to sell its large holding in the token in order to raise vital funds. Financial Times

ETFs in Japan

A BlackRock Japan ETF could be the biggest beneficiary (effective in December) of a change in the Bank of Japan’s ETF purchasing programme, which will focus on investing in the most affordable products.

BlackRock has the three cheapest ETFs listed in Japan with fees set at 0.045 per cent, according to Tokyo Stock Exchange data. One of the three, the iShares Core Topix ETF, tracks the country’s benchmark Topix.

The BoJ currently only invests in ETFs that track the Topix index, although the central bank does not disclose exactly how much it has invested in each product.

Since 2010, the central bank has become the biggest ETF investor, owning 63% of fund assets, worth about $325bn at the end of end February, according to ETFGI. Financial Times

Human element

It has been nearly 30 years since the first ETF began trading in the U.S., so it is rare to find a new first for the industry to occur.

However, this week the PIMCO Active Bond ETF (BOND) became the first active ETF to be traded from an actual booth on the New York Stock Exchange floor.

Most securities are traded digitally with the NYSE’s electronic trading system, Arca. But PIMCO’s ETF transfer to the exchange floor will have the additional element of human oversight by a Designated Market Maker providing trading support.

On a side note, actively managed ETFs listed in the States gathered $59 billion in the first ten months of 2022, equal to 12% of the industry’s net inflows, despite representing just 5% of ETF assets. ETF Trends

Additional reads

London loses crown of biggest European stock market to Paris. Bloomberg

Blackrock shelves China bond ETF. investing.com

BlackRock and Invesco downgrade Article 9 Paris-aligned ETFs. ETF Stream

Not all ETF issuers in Europe are experiencing inflows this year. Financial Times

Better than ETFs? Direct indexers make their pitch to RIAs. Citywire

Investors pump record sums into leveraged ETFs. Financial Times

Amundi targets ‘economies of scale’ with latest Lyxor ETF merges. ETF Stream

From behind the desk with Andrea Murray

I recently had a discussion with a fellow American who questioned if US ETF issuers truly are interested in the European ETF launch process – he was sceptical to say the least.

And to be honest, I was shocked as we speak with many firms who are looking to do this very thing. How could he not know?

And the evidence for demand is clearly there, especially with the recent news of Goldman Sachs entering the white label (ish for GS) space along with Waystone, Leverage Shares, Iconic, Axxion, and first to market, HanETF.

I don’t think a firm like GS would create a platform and offer to help clients launch ETFs if there wasn’t demand for it.

But does the market really need this many firms to help issuers launch ETFs? We include ourselves in this group as a consultancy.

Without a doubt yes. Why?

Because it is almost impossible to duplicate the US ETF launch and distribution process here in Europe – and we have seen firms learn this the hard way.

The markets are vastly different as the European ETF market is incredibly complex with hurdles that most don’t consider because they simply are non-existent in the US.

I like to use the breakfast food analogy of the beloved American donut versus the Parisian croissant. Both delicious but have you ever tried to make a croissant successfully? Of course not. Some things are much better leaving with the professionals.