Will Online Platforms Finally Crack the Retail Market?

A recent survey by PwC found that online platforms are now forecast to be the primary source of future ETF demand. The question is, will this finally propel retail adoption of ETFs forward?

Fund Launches and Updates

EMEA

BlackRock has listed the following four funds on Euronext Amsterdam and SIX Swiss Exchange: iShares MSCI World Materials Sector ESG UCITS ETF (WMTS), iShares MSCI World Communication Services Sector ESG UCITS ETF (WCMS), iShares MSCI World Industrials Sector ESG UCITS ETF (WINS), and iShares MSCI World Energy Sector ESG UCITS ETF (WENE). ETF Strategy

Effective 21 June, Invesco becomes the second issuer to shut its Russia ETF, the $35m Invesco RDX UCITS ETF (RDXS), after BlackRock announced it would delist its Russia and Eastern Europe strategies last month. ETF Stream

Melanion Capital recently listed the Melanion BTC Equities Universe UCITS ETF on the Borsa Italiana. The Borsa Italiana has yet to accept spot crypto ETPs but is allowing thematic ETF in the space. The ETF was first launched October 2021 on Euronext Paris. Cointelegraph

SparkChange Physical Carbon EUA ETC (CO2), has listed on Deutsch Börse XETRA and Borsa Italiana. As well as being listed in the UK, Germany, and Italy, CO2 is also passported to the Netherlands, Finland, Luxembourg, Denmark, Norway, Sweden, Belgium, Spain, and France. ETF World

THE AMERICAS

ConstrainedCapital has launched its debut ETF, the Constrained Capital ESG Orphans ETF (ORFN US), on NYSE Arca, coming to market in partnership with white-label ETF issuer Tidal ETF Services. Expense ratio is 75bps. ETF Strategy

Franklin Templeton is overhauling four of its oldest equity ETFs, ditching multifactor smart beta strategies and opting for a focus on dividend-paying stocks. The firm will change the investment strategies, expense ratios, indices and names of three ETFs: the $20mn LibertyQ International Hedged Equity ETF, $16mn LibertyQ Emerging Markets ETF and $15mn LibertyQ Global Equity ETFs, effective August 1. More details here: Financial Times

$15.2bn AUM provider Pacer ETFs is celebrating their 7-year anniversary this week and has also launched two new funds: the Pacer Data and Digital Revolution ETF (NYSE Arca: TRFK), and the Pacer Industrials and Logistics ETF (SHPP). Vettafi

DoubleLine plans to liquidate a bond fund that was slammed by outflows in late 2021 — the $10.2m DoubleLine Ultra Short Bond fund is set to liquidate July 29, about six years after its inception.

More mutual fund conversions as JP Morgan converts the $5.3bn ‘Research Enhanced’ mutual fund to an ETF. The JPMorgan International Research Enhanced Equity ETF (JIRE US) has been listed on NYSE Arca with an expense ratio of 0.24%. ETF Strategy

Putnam Investments plans to add the following three ESG bond ETFs to its suite: Putnam ESG Core Bond ETF, Putnam ESG High Yield ETF, and the Putnam ESG Ultra Short ETF. Citywire

PIMCO is expanding its actively managed fixed income ETF suite with the addition of the PIMCO Senior Loan Active ETF (LONZ). Global Newswire

UnitedStatesCommodityFunds(USCF) has launched a new actively managed equity ETF on the NYSE Arca, the USCF Dividend Income Fund (UDI US). Expense ratio of 0.65%. ETF Strategy

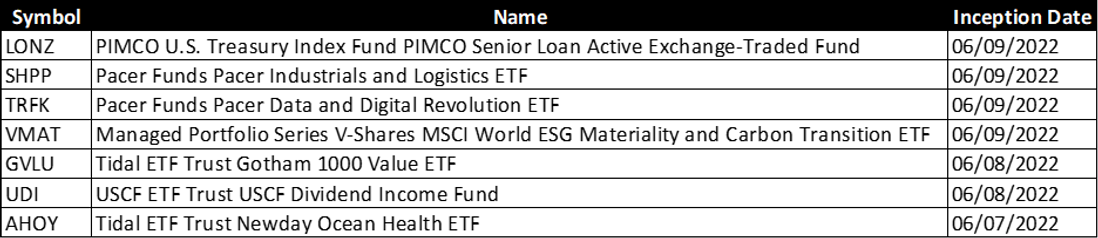

Full List of U.S. ETF Launches:

ASIA-PACIFIC

Samsung Asset Management (Hong Kong) Limited announced the launch of Samsung Blockchain Technologies ETF, the first ever global blockchain related ETF in Asia. The listing date will be on 23 June 2022 on the Stock Exchange of Hong Kong. PRN Asia

Fund Flows

Net flows into government bond ETFs hit a record high in May. Purchases of sovereign bond ETFs surged to $26bn, according to data from BlackRock, up from $15.9bn in April and far ahead of the previous monthly record of $18.5bn, set in December 2018.

The buying was focused almost exclusively on the US market, which accounted for 96% of net inflows. Financial Times

Noteworthy

A recent survey by PwC of industry participants found that online platforms were now forecast to be the primary source of future ETF demand.

This is not really surprising given the laundry list of European firms which have launched or ramped up attention to this space including: UK start-up InvestEngine, Dodl, and €6bn digital investment platform Scalable Capital, which has helped to turbocharge ETF investment in Germany. Financial Times

A recent survey conducted by HANetf of 60 wealth managers and IFAs across Europe reveals that financial professionals expect both their own exposure to thematic funds and the wider thematic ETF market in Europe to continue to grow.

Over 73% of professional investors surveyed reported they have over 15% exposure to thematic funds in the portfolios they manage and 90% expect to increase their thematic exposure over the next 12-months. Most responded they are bullish on blockchain, decentralised finance, renewable and clean energy, and Metaverse themes. ETF Express

The European Securities and Markets Authority (ESMA) has highlighted several concerns around ETF securities lending fee practices, including fee and revenue splits between the asset managers and securities lending agents, according to a new report.

The report found securities lending agents working on fixed fees retain between 10-50% of the gross revenue created by the transaction, with the rest being returned to the UCITS fund. Of this, ESMA found, only between 50-65% of the gross revenues was passed on to the end investor by the asset manager. ETF Stream

In the U.S., Charles Schwab will pay $187mn back to clients after the SEC condemned its robo-adviser service for “egregious” allocations of client money that saddled them with “hidden costs”. The regulator alleged that from March 2015 to November 2018, Schwab did not disclose to customers that its decision to keep a large portion of robo-advised assets in cash — an average of 13% per portfolio — was costing them money because cash holdings would underperform assets such as equities.

Schwab profited by allocating customer cash into an affiliated bank and earned interest by loaning it out, failing to pass along the full interest to clients and creating a “conflict of interest”, the SEC said. Financial Times

Additional reads

Leverage Shares enters white labelling market with active short and leveraged ETP. ETF Stream

Franklin Templeton has created a new ETF Proficiency Course available on the Canadian ETF market, a user-friendly platform that provides unrestricted access to institutional-grade market data, research, and analysis on all Canadian-listed ETFs. Wealth Professional

More stepping up at Grayscale ahead of the July 6 SEC decision with their recent addition of a former U.S. Solicitor General as a senior legal strategist. Cointelegraph

Citadel Securities ready for Crypto ETFs if and when Regulators approve. Bloomberg

DoubleLine has big ETF expansion plans in the works. Citywire

J.P. Morgan Integrates with ICE ETF Hub creating connectivity for its ETF issuers. Fintech Futures

According to a recent UCLA study, passive investing is increasing the volatility of the US stock market. Financial Times