Global ETF assets cross $10 Trillion

Incredible milestone and fun to watch as the numbers keep propelling upwards.

Good timing with today’s announcement of an exciting new launch from HANetf and ETC Group and a potential third futures-based bitcoin ETF from VanEck expected to launch in the US today.

Fund Launches and Updates

EUROPE

Great timing being at the DASLondon conference and being able to report on the newest product from HANetf and ETC Group: the Blockchain Equity UCITS ETF (ticker: KOIN).

KOIN will list on London Stock Exchange, Borsa Italiana and Deutsche Boerse and will be passported for sale across Europe with a TER of 0.60%. Link

HSBC Asset Management has expanded its climate ETF range with the launch of a Japanese equities strategy.

The HSBC Japan Climate Paris Aligned UCITS ETF (HPJP) is listed on the London Stock Exchange with a total expense ratio of 0.18%. Link

KraneShares has swapped the index and changed the name of its China onshore equity ETF.

The KraneShares MSCI China A Share UCITS ETF (KBA) has seen its name changed to the KraneShares MSCI A 50 Connect UCITS ETF (KA50) after it switched from the MSCI China A index. Link

Effective 27 October, the Lyxor Robotics & AI UCITS ETF (ROAI), the Lyxor World Water UCITS ETF (WATC) and the Lyxor MSCI Taiwan UCITS ETF (TWLN) all swapped to thematic indices. Link

Rize ETF has expanded its range with the launch of a thematic ETF focused on the transition to digital and crypto payments economy.

The Rize Digital Payments Economy UCITS ETF (PMNT) is listed on the London Stock Exchange, Deutsche Boerse, Borsa Italiana and SIX Swiss Exchange with a total expense ratio of 0.45%. Link

State Street Global Advisors has launched the SPDR Bloomberg Barclays China Treasury Bond UCITS ETF (CHGT) which is listed on the Deutsche Boerse and Boerse Frankfurt with a total expense ratio of 0.19%. Link

VanEck has launched its first actively-managed ETF, the VanEck Vectors Smart Home Active UCITS ETF (CAVE), which is listed on the London Stock Exchange, Deutsch Boerse and Euronext Amsterdam. The total expense ratio is 0.85%. Link

AMERICAS

The first exchange traded fund to take an inverse exposure to another ETF launched last week in the U.S.

The Tuttle Capital Management’s Short Innovation ETF (SARK) listed on the Nasdaq providing inverse returns, on a single day’s basis, of ARKK. SARK charges a 75 basis point fee, the same as ARKK. Link

In Canada, Harvest Portfolios Group, launched a new thematic ETF that targets the sports and entertainment industry, particularly higher-growth areas of online gambling and professional video gaming.

The Harvest Sports & Entertainment Index ETF (HSPN) will track the Solactive Sports & Entertainment Index, which has been purpose-built for this ETF and has a management fee of 0.50%. Link

ASIA-PACIFIC

Samsung Asset Management HongKong has launched a new equity ETF providing global exposure to companies operating within the semiconductor industry.

The Samsung Bloomberg Global Semiconductor ETF (3132HK) has been listed on the Stock Exchange of Hong Kong and comes with a management fee of 0.85%. Link

Flows

Assets under management held by ETFs globally have broken through the $10trn barrier, just six months after the $9trn figure was broached.

According to data from EPFR, the passive model has taken just one year to grow from $7trn to $10trn, with North America holding the lion’s share at 65% of total AUM globally.

ETFs now comprise a quarter of all equity assets around the world and 15% of total bond fund assets.

While North American assets far outweigh the rest of the world, globally focused products take the second spot, with 13% of assets, followed by emerging market ETFs at 9%, Asia Pacific funds at 7%, with European-focused ETFs rounding out the regions at 5%. Link

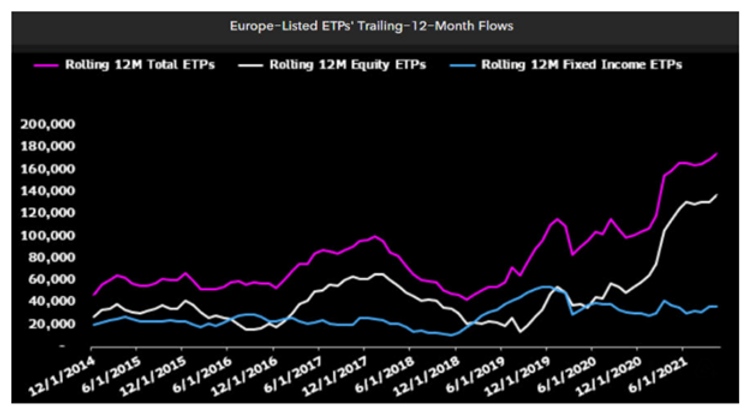

Europe took in about 11B in October, bringing YTD flow total to 146B, according to a recent note from Athanasios Psarofagis.

Been pretty much all to equities, fixed income and commodities are fading off.

Every ETF with the word “inflation” in either its name or description has posted inflows so far this year, according to Bloomberg data.

The 18 products, spanning asset classes and with strategies designed to outperform when prices rise, have so far lured $35.5 billion in new cash, the data show. Link

Australia’s ETF industry broke yet another record through October, as investors of all ilks continue to flock to the product.

As October drew to a close, the Australian ETF industry set a fresh market capitalisation record of $126.9 billion, up $1.7 billion on the $125.3 billion recorded in September.

Total in-flows across the ETF industry were $2.4 billion through October, down slightly on September’s $2.9 billion record. Link

Noteworthy

74% of institutional investors now more likely to “divest” based on poor ESG performance and 90% say they now pay more attention to companies’ ESG performance when making investment decisions, according to a recent EY Global Investor survey.

The report, now in its sixth year, canvasses the views of 320 institutional investors across 19 countries. Link

Bitwise Asset Management is dropping its application to list a Bitcoin futures ETF, while keeping its filing for a physically backed fund.

That follows a similar move by Invesco Ltd., which announced it wouldn’t pursue its futures-based ETF just hours before the first one launched last month. The decision boils down to the structure of the Bitcoin futures curve and expensive roll costs which can eat away the returns in a significant way. Link

US regulators on Friday rejected a high-profile attempt to list a bitcoin-based exchange traded fund on Wall Street, citing worries over the potential that fraud in the crypto market will reach regulated exchanges.

The Securities and Exchange Commission denied the application for the VanEck Bitcoin ETF on concerns over “fraudulent and manipulative acts and practices” in the markets where bitcoin is traded. Its decision was based on a need “to protect investors and the public interest”, it added.

VanEck is expected to launch their futures based crypto ETF today. Link

Additional reads

Index innovator BITA has received EUR6 million of Series a funding by ETFS Capital. Link

Investors question trading of ETFs off-exchange. Link

GHCO’s outlook for the European ETF market. Link

A recent survey from Fidelity found that more than half of institutional investors in Asia, Europe and the U.S. currently invest in digital assets — and a majority also expect they will in the future. Link

Anti-Woke ETFs are pitching to Conservatives Mad at Corporate America. Big eye roll from our end. Link

American Century accused of ‘closet indexing’ in lawsuit. Link

Exchange-traded fund platform ETFbook has joined forces with smart data and analytics company Big XYT to help improve transparency for investors in European ETFs. Link

ETF Stream has revealed the shortlist for its inaugural ETF awards on 2 December at the De Vere Grand Connaught Rooms in London. We hope to see you there! Link

Major sector ETFs face risk of large tech companies being reclassified. Link