European ETFs set new monthly record

The year has started off on a strong note for European ETFs setting a new monthly inflow record. A decade ago, few talked about the ETF market in Australia but today the country Down Under is surpassing all other regions in terms of asset growth. And Morningstar cuts massive list of funds from sustainable list.

Fund Launches and Updates

EMEA

21Shares has launched two crypto ETPs tracking decentraland and FTX. The 21Shares Decentraland ETP (MANA) and the 21Shares FTX Token ETP (AFTT) are listed on the BX Swiss with total expense ratios of 2.5%. Link

Chimera Capital, an Abu Dhabi asset management company and subsidiary of Chimera Investments, is introducing a Sharia-compliant ETF that will give investors access to Kuwait’s equity markets. The Chimera S&P Kuwait Sharia ETF will be listed on the Abu Dhabi Securities Exchange. Link

Deka has launched a new subsidiary, SWIAT GmbH, to offer clients blockchain-based solutions for securities processing. The core of the business is the transaction and innovation platform SWIAT (Secure Worldwide Interbank Asset Transfer). Link

Global X has launched the Wind Energy Ucits ETF and the Hydrogen Ucits ETF on the London Stock Exchange and the Deutsche Börse Xetra. Both funds track Solactive indices with a TER of 0.5%. Link

Invesco has cut fees on 18 sector ETFs tracking financial services, commodities, utilities, travel and leisure, retail, technology and industrial goods and services from 0.30% to 0.20%. Link

WisdomTree has launched the WisdomTree New Economy Real Estate UCITS ETF (WTRE) on the London Stock Exchange, Deutsche Boerse and Borsa Italiana with a total expense ratio of 0.45%. Link

AMERICAS

In Canada, Horizons ETFs launched the Horizons Carbon Credits ETF (CARB) on the Toronto Stock Exchange. Link

In the U.S., Elemental Advisors has entered the ETF space with the launch of the PSYK ETF (PSYK), a psychedelics thematic product.

We went down a rabbit hole trying to confirm the details with this one and discovered that there is actually an ETF in Canada by Horizons ETFs with the same ticker (it was the world’s first psychedelics ETF and has over $30m in AUM).

Anyway, according to an Ultumus report, there are two other psychedelics ETFs in the U.S. –(PSY, PSIL) which hold just $8M and $6M each. Link

The $856 million Roundhill Ball Metaverse ETF (ticker METV – previously META until they gave it over to well, Meta) cut its management fee to 0.59% from 0.75%.

Both Fidelity Investment and Global X Funds have filed applications for metaverse products in the past two weeks. Link

Full list of U.S. launches

50 new funds have launched in 2022, compared with 38 at this point last year, according to Bloomberg data. Link

Flows and Trading Volume

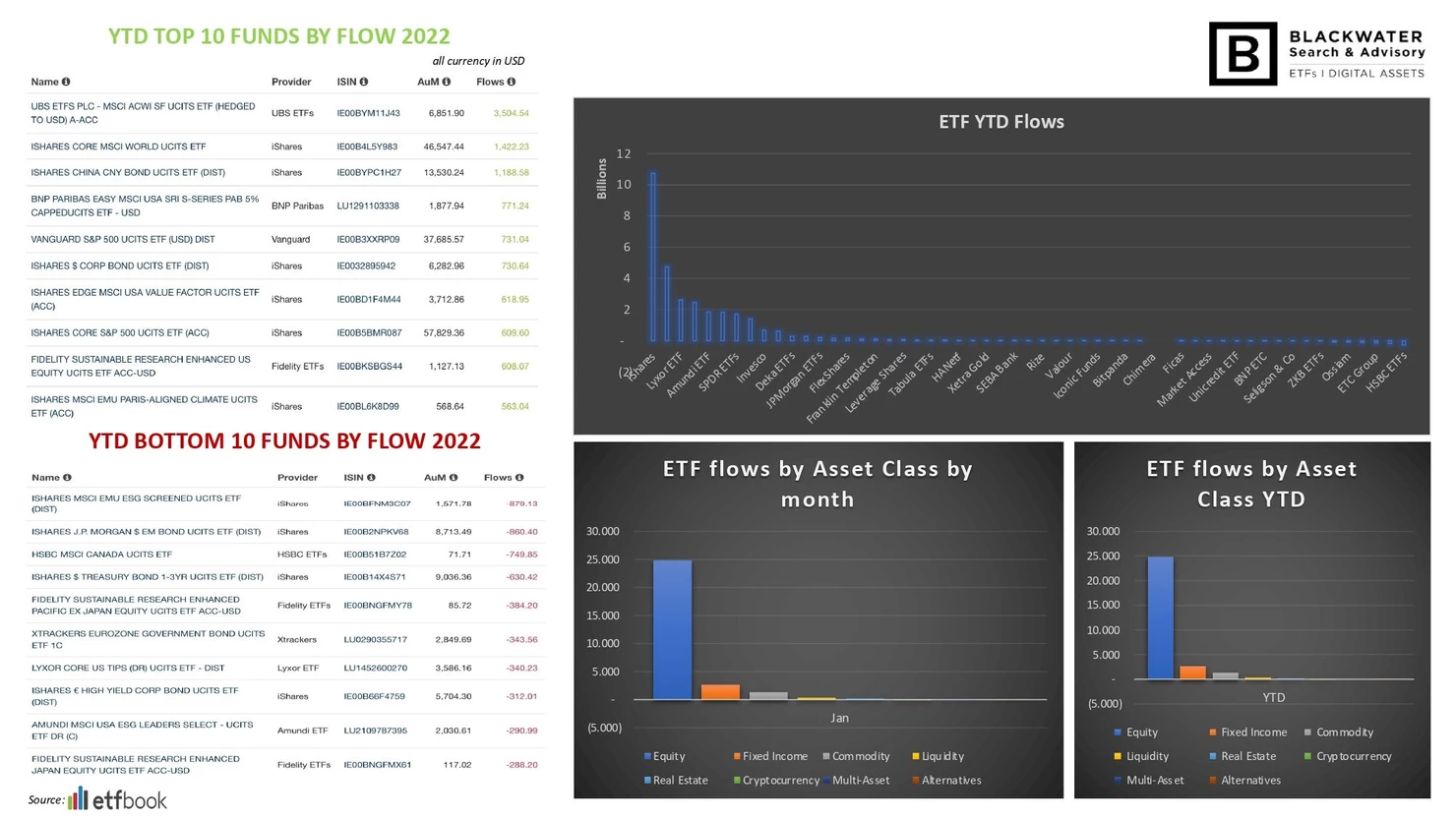

Equities continue to be the asset class of choice, capturing 85% of all inflow vs 9% for Fixed Income. A tough start to the year for cryptocurrencies suffering from outflows of $168m.

January saw investors pull $1.5bn globally from fixed income ETFs for the first time in more than five years.

A much different picture from the $27.3bn of inflows seen in December.

The selling was driven by $7.6bn from high-yield bond ETFs, while inflation-linked bond ETF flows had a net $1.7bn of selling with US-focused ETFs again bearing the brunt. On the positive side, local currency denominated emerging market debt took in $3bn in January. Link

Say what you will about 13F filings but sometimes it is worth a look.

We took a peek at the inaugural 13Fs for first two bitcoin futures ETF filers for the Valkyrie Bitcoin Strategy ETF and the ProShares Bitcoin Strategy ETF which are listed here for BTF and here for BITO.

Noteworthy

Now the research firm only recognises 4,461 European funds with combined assets of $2.23tn as sustainable compared to the 6,659 classified, with assets of $4.6tn, under SFDR rules.

Fidelity’s little-known passive investment business Geode Capital Management surged to $1tn in assets last year, underscoring its quiet emergence as a major player in the index fund industry.

Doubling in size over the past two years, Geode’s rapid growth has helped Fidelity leapfrog State Street Global Advisors to become the world’s third-biggest money manager with assets of $4.5tn at the end of 2021.

“Every business house has to change,” Fidelity’s chief executive told the Financial Times in a 2019 interview. “If you don’t change, you’re by definition either on your way to atrophy or you are atrophying.

The world changes. You have to evolve your business and challenge yourself to say, ‘Where are things going?’” Well said. Link

BlackRock Inc. is boosting its offering of products that allow Brazilians to access international exchange-traded funds.

Blackrock Inc. is opening up six of its fixed-income ETFs through Brazilian depositary receipts. They twill be listed on the local exchange operator B3 SA.

The Brazilian industry of ETFs has grown about 42% in the past two years to over $7.8 billion. Major room for growth as only 0.6% are invested in ETFs across the entire 6.9 trillion reais fund market. Link

Some varying opinions on the impact of liquidity provider Bluefin suddenly exiting the European market.

ETF Stream highlighted that Jane Street and Flow Traders are the two main independent liquidity providers with the majority of market share, with Bluefin’s exit highlighting just how difficult it is to make ground in a competitive market.

You could say the same about ETF issuers – there are the same big three firms that hold the majority of ETF assets but that doesn’t stop other firms from participating.

As Keshava Shastry commented in the article: “just because you see two or three names regularly winning business does not mean they are the only ones active, they are just winning by a small amount when investors put market in competition for getting best execution.” Link

Additional reads

Great article featuring Jillian DelSignore head of ETF’s and Indexing at FLX Distribution. She shares her insights on what it takes to successfully break into the US ETF market. Link

Amundi surges past €2tn in assets under management after Lyxor deal. Link

A suite of MSCI ESG indices outperformed their non-ESG parent despite surging energy stock prices last year, but analysts say the findings deserve careful scrutiny. Link

ECB investigates DWS over corporate governance issues. Link

DWS’s China CSI 300 ETF pulls in $500m inflows following rebalance. Link

Harbor Capital Advisors, the parent company of the Harbor funds, is set to launch a series of mutual fund to ETFs. The firm wants to convert at least one of its mutual funds to an ETF this year with plans to have a total of 12 ETFs by year end. Link

Investors air their thoughts as to why the SEC should approve the conversion of Grayscale’s BTC Trust into a spot ETF. Link

And a fun one. Apparently, the Coinbase site crashed from traffic due to a Super Bowl ad that sparked public interest.

Normally commercials are the worst but the Superbowl commercials are usually worth watching – at least during the game. Minute 5.05 in this Link has the crypto commercial that allegedly led to the Coinbase crash.