Non-transparent ETFs in the U.S stall

A busy week for launches in both Europe and the U.S.

And in the States, portfolio shielding ETFs have not taken off as expected.

Fund Launches and Updates

EMEA

DWS has expanded its fixed income ETF suite with the launch of the Xtrackers Eurozone Government Green Bond UCITS ETF (XGEZ).

XGEZ is listed on the Deutsche Boerse XETRA and London Stock Exchange, TER 0.18%. ETF Stream

Legal & General Investment Management launched the L&G Asia Pacific ex Japan ESG Exclusions Paris Aligned UCITS ETF and the L&G Japan ESG Exclusions Paris Aligned UCITS ETF on the London Stock Exchange, Deutsche Boerse XETRA and SIX exchanges.

The Article 9 ETFs have TERs of 0.16%.Investment Week

VanEck has launched the VanEck Circular Economy UCITS ETF on the London Stock Exchange, total expense ratio of 0.40%. Investmentweek UK

AMERICAS

In Canada, Harvest Portfolios has introduced the following: ‘Enhanced Equity Income’ ETFs on the Toronto Stock Exchange:

The Harvest Tech Achievers Enhanced Income ETF (HTAE CN), management fee of 0.85%.

The Harvest Healthcare Leaders Enhanced Income ETF (HHLE CN), management fee of 0.85%.

The Harvest Equal Weight Global Utilities Enhanced Income ETF (HUTE CN), management fee of 0.50%.

The Harvest Brand Leaders Enhanced Income ETF (HBFE CN), management fee of 0.75%.

The Harvest Canadian Equity Enhanced Income Leaders ETF (HLFE CN), management fee of 0.65%. ETF Strategy

In the States, Angel Oak Capital Advisors, a fixed income specialist with more than $20 billion in assets under management, has made its ETF debut with the launch of an actively managed fund investing in short-duration structured credit assets.

The Angel Oak UltraShort Income ETF (UYLD US) has been listed on NYSE Arca with an expense ratio of 0.29%. ETF Strategy

Capital Group has launched the following three new transparent actively managed fixed income ETFs:

Capital Group Municipal Income ETF (CGMU)

Capital Group U.S. Multi-Sector Income ETF (CGMS)

Capital Group Short Duration Income ETF (CGSD). VettaFi

In the world of conversions:

Franklin Templeton is converting two mutual funds to ETFs.The two converted funds are the BrandywineGLOBAL–Dynamic US Large Cap Value ETF (NASDAQ: DVAL) and the Martin Currie Sustainable International Equity ETF (NASDAQ: MCSE). Businesswire

Neuberger Berman has converted its Neuberger Berman Commodity Strategy Fund into the Neuberger Berman Commodity Strategy ETF (NBCM).

Following the conversion, NBCM has about $196 million in assets. VettaFi

Simplify Asset Management has launched the Simplify Enhanced Income ETF (HIGH) and the Simplify Stable Income ETF (BUCK).

HIGH and BUCK will be listed on the NYSE Arca and have expense ratios of 0.51% and 0.36% respectively. Yahoo Finance

T. Rowe Price launched its ninth ETF — the T. Rowe Price U.S. High Yield ETF (THYF) which is a fully transparent actively managed junk bond ETF.

THYF lists on the NYSE Arca and charges an expense ratio of 0.56%. Yahoo Finance

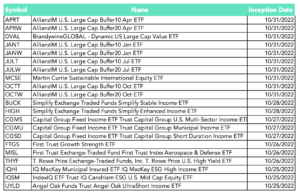

Full list of U.S. launches:

ASIA-PACIFIC

Fidelity International has launched an ETP that offers exposure to Bitcoin to selected professional investors in Hong Kong.

The ETF is physically backed by Bitcoin and is the first of its kind to be made available in Hong Kong. Fund Selector Asia

Flows

In the States, portfolio-shielding ETFs have struggled to gain traction among investors in the two years since the first products launched.

As of 30 September, non-transparent ETFs had $4.4bn in assets representing only 1.5% of the active ETF market. And according to the report, nearly half of those assets are in the $2.1bn Nuveen Growth Opportunities ETF.

Part of the reason why non-transparent ETFs have struggled to gather assets is that major broker-dealers have been slow to add the products to their platforms.

However, this year, UBS, Merrill Lynch and Morgan Stanley Wealth Management said they would start offering a small number of portfolio-shielding ETFs on their platforms. Financial Times

Noteworthy

New regulations on ETFs

ETF Stream has published a handy summary of the upcoming SFDR ESG regulation upgrade outlining its impact on ETFs as well as investors. Delayed six months until January 2023 due to the “length of technical detail” of the directive, ETF issuers now have less than three months to be compliant with the new regulations.

A couple of quick highlights from the article: the proposed level 2 regulatory technical standard (RTS) has been designed to supplement the level 1 text, giving more detail on what asset managers will have to disclose and how it should be presented with a focus on sustainability risks, sustainability factors and technical disclosures.

How will the changes impact ETFs?

The biggest impact facing ETFs will be the potential downgrade of products that do not meet the more stringent sustainability criteria required by level 2. ETF Stream

Direct Indexing claims

In the U.S., ETFs are preferred to mutual funds for investors looking to own baskets of stocks in a tax efficient manner and have been for a while. But claims that direct indexing may make ETFs obsolete are growing as fintechs look to bring direct indexing mainstream.

The rise of commission-free trading in the States has essentially removed the fee barrier to direct indexing, causing firms like San Francisco fintech Atomic Invest to chase the opportunity to bring the strategy to small investors.

According to CEO David Dindi, “we believe that ETFs will be dead in the next five years”. Yikes, we don’t agree at all and have a white paper on direct indexing coming out soon so keep an eye out for that.

In the US, direct indexing AUM grew from $100 billion to $350 billion between 2015 and 2020 and is projected to grow 12% in the next 5 years, outpacing ETFs and mutual funds.

Atomic isn’t the only company moving to provide direct indexing more broadly. Fidelity, Vanguard, Blackrock and Morgan Stanley all recently launched direct indexing services.

The features came after Vanguard acquired Just Invest in August 2021, Morgan Stanley purchased Parametric Portfolio in March 2021 and Blackrock took over Aperio back in 2020.

“Many of these traditional financial service institutions have recognized that the future of investing is direct indexing,” Dindi says. “The time left for ETFs is ticking.”. Forbes

Additional Reads

Algo-Chain partners with Leverage Shares on model portfolio ETPs. ETF Stream

Index providers charge some asset managers 13 times as much as other clients for similar bundles of products and services. Financial Times

MerQube kicks-off push in Europe with new hire and UBS AM partnership. ETF Stream

Five of the worst ETF first-year performances are crypto-related. Financial Times

Dividend ETFs are notching relentless inflows as traders take refuge in the stock-market storm. Wealth Management

Halloween was yesterday so fitting to have an article about ETFs which have ended up in the graveyard – over 100 so far this year. Bloomberg

Slump in crypto ETF’s share price cements it as sixth worst-performing debut ETF ever of its kind. Wealth Professional

Hargreaves Lansdown will no longer offer the foreign currency share classes of certain ETFs. Investors Chronicle

Hong Kong is now set to allow crypto investments to retail and institutional investors. Finance Magnates

Congratulations to all of the ETF Express winners in the U.S.! Full list here: ETF Express

From behind the desk with Andrea Murray

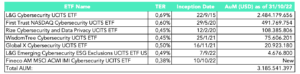

Phil Mackintosh, Nasdaq Chief Economist, wrote a piece some weeks ago on the increasing importance of cybersecurity and as it relates, the growing strength and popularity among cyber-ETFs in the States.

Personally, I woke up this week to two unrecognized purchases on my credit card – someone thought it would be fun to not only pay off their very large energy bill but also book themselves what I am guessing are roundtrip flights to a tropical destination based on the eye-watering amount.

So, before I go onto a rant about my thoughts on the type of human that does that, let’s transition to ETFs here in Europe. There are quite a few products to choose from and a very respectable amount of assets for each.

Let’s take a look at the current Europe cybersecurity ETF landscape, courtesy of our friends at ETFbook.com