busy week with April ETF flows

Mixed bag of global ETF flows

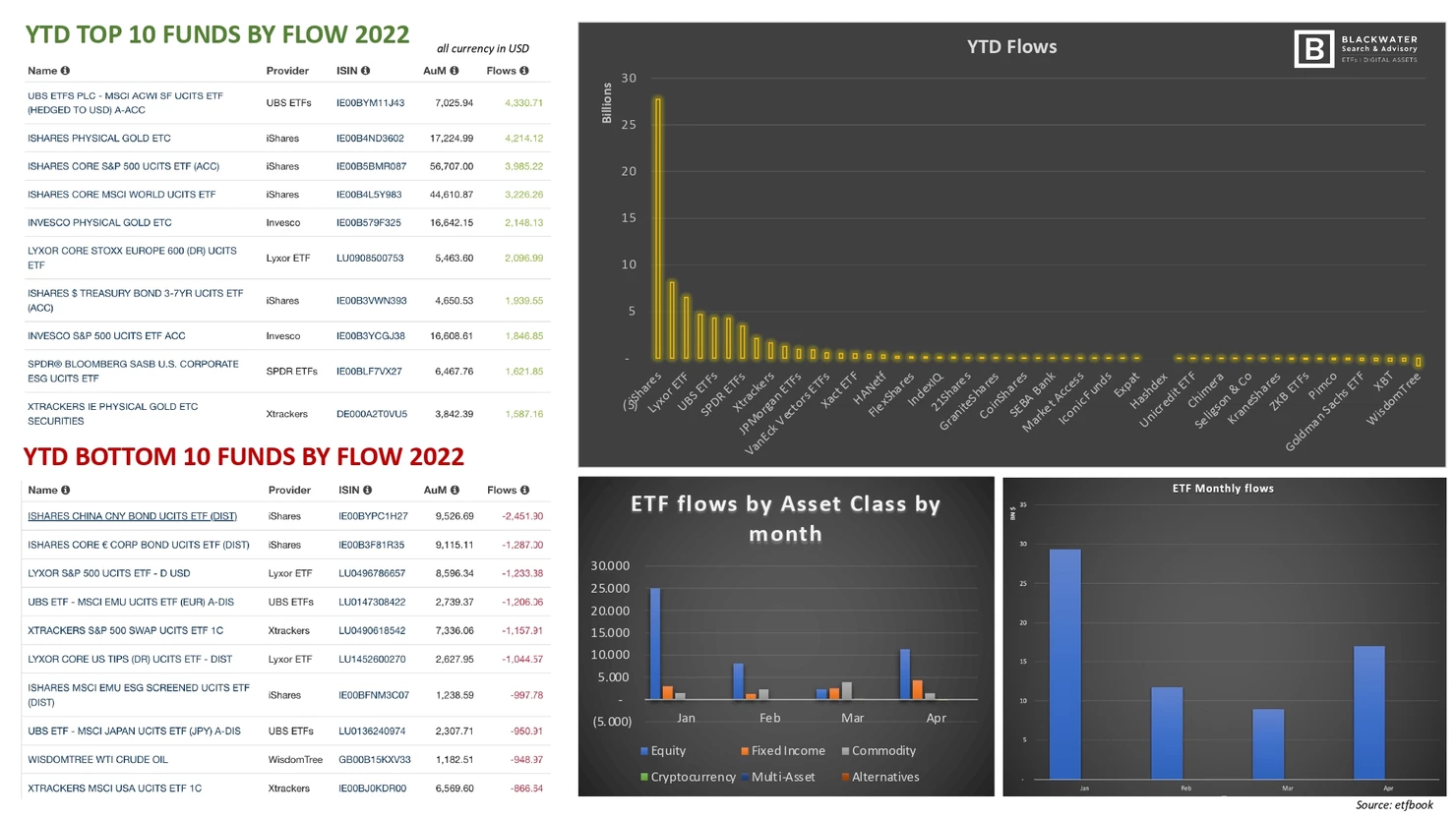

A busy week with April ETF flows being reported across the globe.

And finally, after a two-2week delay, it looks like Australia is ready to be next in line for their first physical crypto ETFs.

Fund Launches and Updates

EMEA

DWS plans to swap the indices on the £245m Xtrackers MSCI Canada UCITS ETF (XCAN) and the £314m Xtrackers MSCI Pacific ex Japan UCITS ETF (XPXJ) to include ESG metrics.

As a result of the changes, XCAN will change its name to the Xtrackers MSCI Canada ESG Screened UCITS ETF while XPXJ will be renamed Xtrackers MSCI Pacific ex Japan ESG Screened UCITS ETF. Separately, DWS is also adding an ESG screen to its Xtrackers DAX Income UCITS ETF (XDDX). ETF Stream link

AMERICAS

In Canada, CI Global Asset Management launched the CI Galaxy Blockchain ETF (CBCX) and the CI Galaxy Metaverse ETF (CMVX) on the Toronto Stock Exchange. Each has an annual management fee of 0.50%. Financial Post

ASIA-PACIFIC

Cboe Australia. After a two-week delay, Australia’s first listed cryptocurrency investment funds will begin trading this Thursday on the Cboe exchange.

Cboe Australia confirmed that it will commence hosting three new exchange-traded funds – the Cosmos Purpose Bitcoin Access ETF, ETFS 21Shares Bitcoin ETF and ETFS 21Shares Ethereum ETF on May 12. Australian Financial Review

Fund Flows and Trading Volume

In Canada, over $1.5 billion flowed into Canadian ETFs in April, a sharp decline after inflows of $13.5 billion over the first three months of the year.

Equity ETFs attracted $917 million which was down from $2.5 billion in March. Bond ETFs attracted $645 million in new money and crypto ETFs saw outflows of $338 million. Investment Executive

Globally, BlackRock reported that monthly allocations to global ETPs fell to their lowest level since March 2020 in April, with $27.4 billion of inflows, down from $117.4B in March.

While inflows dropped across asset classes, they fell most acutely in equities, where just $2.8 billion was added (down from $76.2 billion in March).

Fixed income flows fell slightly from $25.5 billion to $18.8 billion, while commodity flows tempered to $3.6 billion. ETF Express

In the U.S., State Street reported that U.S. listed ETFs had $6.1 billion of net outflows in April, marking the end of a record-setting 34-month net inflows streak during which they took in $1.8 trillion is assets.

Equity funds led April’s outflows at $20.3 billion, according to the report.

Noteworthy

In the U.S., Cboe Global Markets has acquired Eris Digital Holdings (ErisX), an operator of a US-based, digital asset spot market, a regulated futures exchange and a regulated clearinghouse.

Ownership of ErisX allows Cboe to enter the digital asset spot and derivatives marketplaces and in addition to operating the existing spot, derivative and clearing platforms.

Cboe also intends to develop and distribute a range of digital asset data products. Hedgeweek

Franklin’s latest financials put the firm’s ETF business at about $13bn in assets under management including both active and passive strategies.

Franklin has been particularly acquisitive in recent years, buying Legg Mason in 2020 and O’Shaughnessy Asset Management in January. Citywire Selector link

WisdomTree Investments is the latest fund manager trying to get in on the crypto boom.

However, instead of waiting for SEC spot bitcoin approval like everyone else, they are going the route of separately managed accounts that hold crypto and can be accessed by financial advisers.

“Crypto exchange-traded products in the United States may not be the wrapper with which the customer truly accesses crypto,” said WisdomTree CEO Jonathan Steinberg in an interview with Barron’s.

While such products are on the rise in Europe, in the U.S. “we don’t see that anywhere near on the horizon,” he added. Barron’s

Additional reads

Russia sanctions present unique challenge to the ETF industry ETF Stream

The deadline is looming for investors to opt out of a class action lawsuit over a Canada listed inverse ETF product. Investment Executive

Elon Musk tweets “Passive has gone too far”. ETF Stream

SEI adds hybrid model portfolios with Capital Group ETFs. Citywire USA

Sparks fly in battle for control of WisdomTree. Financial Times

Vanguard makes cost changes to more than $137bn in ETFs and mutual funds. Financial Times

Crypto clouds may part as result of directive. Pensions & Investments

Fund managers including Danske, Nordea and Jupiter have taken steps to permanently shut down funds heavily exposed to Russia. Financial Times