IS ESG THE ONLY SHOW IN TOWN NOW?

ETFs aligned with ESG outcomes accounted for 65 per cent of all net inflows into European ETFs in 2022, even as ESG strategies underperformed, according to the Financial Times.

The ESG ETFs gathered €51bn over the year out of total flows to European-domiciled ETFs of €78.4bn. The overall totals were down on 2021 when investors poured €160bn into European ETFs, but ESG’s share jumped significantly from the 51 per cent recorded then.

Now there is €249bn in ESG-aligned ETFs in Europe, representing 18.8 per cent of total assets.

Fund Launches and Updates

EMEA

Solactive launches Biodiversity Index Series working with Iceberg Data Lab. etfexpress

Solactive have also continued their push into ESG by acquiring UK-based proxy voting and ESG data specialist Minerva Analytics. etfstream

BNP Paribas AM is planning on launching an Irish ETF platform in order to compete with other ETF issuers in Europe, so says etfstream

The first product casualty of the year goes to the Purpose Enterprise Software ESG-S UCITS ETF (SOFT) which is closing on Jan 20th having only raised amassed $4m (AUM) since launching 18 months ago. etfstream

Tabula launches the world’s first Gulf Cooperation Council government bond ETF.

The Tabula GCC Sovereign USD Bonds UCITS ETF aims to offer exposure to government bonds issued by six GCC countries: Saudi Arabia, the UAE, Qatar, Oman, Bahrain and Kuwait. The ongoing charges figure for the ETF is 0.45%. investmentweek

Invesco has expanded its fixed income ESG range with the launch of a global high yield ETF. The Invesco Global High Yield Corporate Bond ESG UCITS ETF (GBHY) is listed on the London Stock Exchange with a total expense ratio (TER) of 0.25%. etfstream

AMERICAS

DWS readies ‘climate action’ ETF. According to filings a prospecuts was submitted last month for the Xtrackers MSCI USA Climate Action Equity ETF, which would focus on large- and mid-cap companies. investmentnews

Hypatia Capital based in NY, has made its ETF debut with a US equity fund that invests in companies with female CEOs or Executive Chairpersons. The Hypatia Women CEO ETF (WCEO US) has been listed on NYSE Arca with an expense ratio of 0.85%. etftrends

Matthews Asia launched the Matthews Emerging Markets ex China Active ETF (NYSE Arca: MEMX) on the New York Stock Exchange with an expense ratio of 0.79% adding to the firm’s active ETF suite. The firm now has four active ETFs since launch. etfstrategy

Kraneshares have launched the KraneShares China Internet & Covered Call Strategy ETF (ticker: KLIP) on the New York Stock Exchange with an expense ratio of 0.95%. Kraneshares

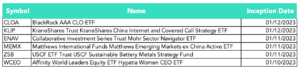

Full list of U.S. launches:

ASIA-PACIFIC

Samsung’s Asset Management arm launches Bitcoin Futures ETF in Hong Kong. Bitcoin.com

Flows

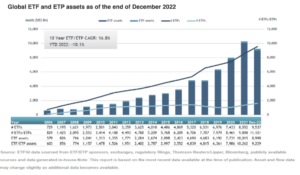

Global ETF industry gathered $856.16 Bn in net inflows in 2022. 2nd highest level of annual net inflows behind the $1.29 Tn gathered in 2021. Nasdaq

Net inflows of $69.37 Bn during December.

43rd month of consecutive net inflows.

Assets of $9.23 Tn invested in global ETFs industry at the end of December 2022.

Assets decreased 10.1% YTD in 2022, going from $10.26 Tn at end of 2021 to $9.23 Tn.

Noteworthy

ESG accounts for 65% of all flows into European ETFs in 2022. ft.com

Scalable Capital the poster child of European online ETF platforms have surpassed one million ETF and stock savings plans. etfexpress

BlackRock cutting jobs and imposing a hiring freeze. Bloomberg

Vanguard launches “Vanguard Invest Direkt” a new self directed investment platform in Germany for retail investors. etfstream

Crushed crypto funds are suddenly beating every other ETF – The 14 top performing ETFs so far this year all tied to crypto. Bloomberg

Additional reads

The majority of exchange traded fund issuers in Europe are expecting assets in smart beta strategies to grow over the next 12 to 24 months, according to a research by Cerulli. Ignites

Cerulli continues their magic ball gazing by predicting strong growth for fixed income ETFs. etfstrategy

Thought of the week

January is typically when we set new goals for the year filled with high expectations – get fit, lose weight, take up a new hobby, etc.

However, come April most of these tend to have been thrown in the bin. We give up.

Remember the greatest predictor of your future are your daily actions.