Axa breaks into Europe

And we are back. Hope you enjoyed the summer holiday and didn’t get stuck in any 5-hour airport lines while travelling. In the world of ETFs, we have three new entrants to welcome: AXA Investment Managers and Fineco Asset Management in Europe, and NEOS in the States.

In Asia, South Korea’s regulator brings the hammer down on triple levered ETFs and in Europe, ETF flows are out and thankfully we can say that we are back in the green.

Fund Launches and Updates

EMEA

AXA Investment Managers has made its long-awaited entry into the European ETF market with the launch of the actively-managed AXA IM ACT Biodiversity Equity UCITS ETF (ABIT).

ABIT will list today on Deutsche Boerse and later this month they plan to launch the AXA IM ACT Climate Equity UCITS ETF. Both ETFs have total expense ratios of 0.70%. ETF Stream

DWS has launched the following three new ETFS: the Xtrackers USA Net Zero Pathway Paris Aligned UCITS ETF (XNUS), the Xtrackers Europe Net Zero Pathway Paris Aligned UCITS ETF (XEPA) and the Xtrackers Japan Net Zero Pathway Paris Aligned UCITS ETF (XNJP).

All three are listed on Deutsche Boerse and the London Stock Exchange with total expense ratios ranging from 0.10% to 0.15%. ETF Stream

Competition heats up in the thematic space as Fidelity International expands its offering with the launch of five new ETFs: the Fidelity Clean Energy UCITS ETF), Fidelity Electric Vehicles and Future Transportation UCITS ETF, Fidelity Cloud Computing UCITS ETF, Fidelity Digital Health UCITS ETF and the Fidelity Metaverse UCITS ETF. Funds Europe

Italian issuer Fineco Asset Management has plans to enter the European ETF market with the upcoming launch of the Fineco AM MSCI ACWI IMI Cyber Security UCITS ETF (FAMMAI) and the Fineco AM MSCI World Semiconductors and Semiconductor Equipment UCITS ETF (FAMMWS).

Both ETFs will list on the Borsa Italiana on 9 September with total expense ratios of 1%. ETF Stream

HSBC Asset Management has reduced the fees on the HSBC FTSE EPRA NAREIT Developed UCITS ETF (HPRD) from 0.40% to 0.24%. ETF Stream

Ossiam has launched the following six Article 9 classified ETFs on Xetra and the SIX Swiss Exchange. ETF Strategy :

Ossiam Bloomberg USA PAB UCITS ETF, 0.12% TER.

Ossiam Bloomberg Canada PAB UCITS ETF, 0.29%.

Ossiam Bloomberg Eurozone PAB UCITS ETF, 0.17%.

Ossiam Bloomberg Europe ex Eurozone PAB UCITS ETF, 0.17%.

Ossiam Bloomberg Japan PAB UCITS ETF, 0.19%.

Ossiam Bloomberg Asia Pacific ex Japan PAB UCITS ETF, 0.29%.

THE AMERICAS

In Canada, Hamilton ETFs launched the Hamilton Enhanced Utilities ETF (HUTS) on the Toronto Stock Exchange. The ETF aims to provide investors exposure to blue-chip, high dividend paying Canadian utility companies. Yahoo Finance

TD Asset Management launched the TD Global Carbon Credit Index ETF (Ticker TCBN) providing investors with global exposure to the growing carbon credit market. TCBN will track the Solactive Global Carbon Credit CAD Hedged Index and has a management fee of 0.65%. TD Media Room

In the U.S., CT Investments, a subsidiary of Contents Technologies, has launched the KPOP and Korean Entertainment ETF (KPOP).

KPOP will provide access to the global growth of Korean entertainment and interactive media through companies listed on Korean exchanges that are related to the Korean pop phenomenon. ETF Strategy

Inspire Investing has expanded its suite of biblically responsible ETFs with the launch of the Inspire Fidelis Multi-Factor ETF (FDLS US). The new ETF has been listed on NYSE Arca with an expense ratio of 0.85%. ETF Strategy

Asset manager NEOS Investments, has launched its initial suite of next evolution income ETFs.

The new actively managed products are the NEOS S&P 500 High Income ETF (SPYI); NEOS Enhanced Income Aggregate Bond ETF (BNDI); and NEOS Enhanced Income Cash Alternative ETF (CSHI). ETF Express

Full list of U.S. launches:

ASIA-PACIFIC

In Australia, BlackRock is expanding its fixed income ETF range with the launch of the iShares Global Aggregate Bond ESG AUD Hedged ETF (AESG), expense ratio 19bps. The Financial Standard

In Japan, Nomura Asset Management Co. Ltd. announced that it will be launching a new ETF which will track the performance of the S&P Balanced Equity and Bond – Conservative JPY Hedge Index (TTM) on the Tokyo Stock Exchange. The management fee is 0.253%. Finbold

In India, asset management company Axis Mutual Fund has launched the Axis Silver ETF, an open-ended scheme tracking the domestic price of silver, and Axis Silver Fund of Fund (FoF), an open-ended fund of fund scheme investing in units of the Axis Silver ETF. Business Today India

Flows

We are back in the green as European ETF flows in August record net inflows of $892m. This compares to the previous month outflows of $3.6bn.

Across asset classes, Equities continue to be out of favour suffering another month of outflows – $3.2bn. Fixed Income continue to attract inflows gaining another $5.3bn for the month. Commodities also continue to suffer outflows of $1.2bn for the month.

Cryptocurrencies remained flat, gaining modest inflows of $35mn during the month.

In terms of individual performers, it was a big month for UBS who recorded $2.9bn of inflows. iShares, Vanguard and JP Morgan all attracted inflows of > $350m. At the other end of the stick, it was a really bad month for Amundi who suffered outflows of $1.8bn.

In the States, a $3.2 billion ETF betting against the S&P 500 pulled in the most cash in over two years last week and at one point had 10 days of consecutive inflows within an 11-day period.

Investors added a net $154.4 million to the ProShares Short S&P 500 ETF (ticker SH), the largest one-day increase since April 2020, according to data compiled by Bloomberg. Bloomberg

Noteworthy

South Korea’s financial regulator, the Financial Supervisory Service (FSS) has raised concerns over retail investors piling into risky leveraged overseas ETFs, that are designed to deliver three times the daily returns of the underlying index.

Triple levered ETFs are banned by the Korean Stock Exchange but as we know, this does not stop retail investors from opening foreign trading accounts and finding a loophole.

According to the FSS, listed overseas 3x ETFs accounted for almost 80% of the top 50 ETPs that South Korean retail investors invested in between January and March 2022.

Which ETFs were most popular? The Korea Securities Depository reported that three products recorded the greatest amount of net purchases from South Korean investors in the first half of the year. They are the ProShares UltraPro QQQ, the Direxion Daily Semiconductor Bull 3X Shares ETF and the MicroSectors FANG & Innovation 3X Leveraged ETN.

Similar to the global trend of an increasing number of trading accounts being opened by investors in their 20s and 30s, South Koreans had opened 4.9mn international trading accounts at the end of last year, a sharp jump on the 2.4mn accounts recorded in 2020.

Between their acceptance of high-tech trading apps and the massive generation wealth transfer, if you are not paying attention to this segment of the market, it’s time to catch up. Financial Times

In the U.S., a storm of resistance is brewing with asset managers who face the potential “Names Rule” proposal.

All ETFs — including the MAGA ETF, Vice ETF, BAD ETF and the not-yet-launched God Bless America ETF — would be required to align 80 per cent of their portfolios with their names, if the proposed amendments are enacted.

Such alignment would be expanded under the proposed amendment to include strategies like ESG, as well as other characteristics and criteria such as “growth” or “income”. The amendment would also require mutual funds and ETFs to define in their prospectuses key terms included in their names.

However, the definitions cannot veer from plain English or the industry-standard understanding of the terms, the proposal states. Sounds like a logistical nightmare that some poor person in Compliance is going to face this year or next. Financial Times

Additional reads

In the last quarter, 700 products switched their SFDR status with the majority upgrading from Article 6 to Article 8, according to Morningstar. ETF Stream

ITI Funds is preparing to shut its ETF business following months of restrictions to Russian assets and the suspension of its two ETFs. ETF Stream

Swiss bank UBS and US robo-adviser Wealthfront have terminated their $1.4bn takeover agreement just over eight months after announcing the tie-up. Financial Times

Singapore’s financial regulator has distanced itself from “heavily speculated” cryptocurrencies after a series of scandals this year. Financial Times

From behind the desk with Andrea Murray

With summer fading fast, an obvious question emerges: Have you figured out your winter energy strategy yet?

If you read the news, there apparently are not enough woolly jumpers in all of Britain to offset the upcoming winter and soaring energy costs expected this year.

Here in Europe, the headlines now explain how to save energy costs by showering at the gym (oh, I do hope people do that before going into work), biking into the office, and actually returning to the five-day commute – all just to stay warm and reduce heating bills.

Meanwhile, in the U.S. you will find plenty of articles about how firms are getting more aggressive beckoning workers back to the office for reasons unrelated to gas issues.

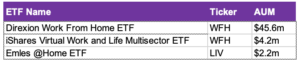

How does this relate to ETFs? Well, it prompted me to check out the asset levels for the 2020 launched thematic ETFs of the same name. It will be interesting to see how these fare in Q4:

And for those who don’t want to finish their summer break, they can always head up to Venice, Italy, where you can get a free dinner courtesy of the Mayor.

You just will need to seek out the two tourists who decided it was a good idea to surf the canals, prompting Mayor Luigi Brugnaro to offer a reward if you identify the two “imbeciles” as he tweeted, “Venice is not Disneyland.”